Margins have always been thin in grocery, but this year the compounding pressures of inflation, labor shortages, and supply chain volatility have pushed operators into survival mode. To protect margins, grocers are leaning harder on technology, allocating an average of 3.32% of revenue to AI – equivalent to $33.2 million annually. Yet much of that investment has failed to deliver. Instead of solving the everyday realities of brick-and-mortar operations, hype-driven AI projects have left associates drowning in dashboards, managers overwhelmed by KPIs, and billions still leaking through phantom inventory, fresh food waste, and inefficient markdowns.

Enhancing People, Products, and Places Through Intelligent Tasking

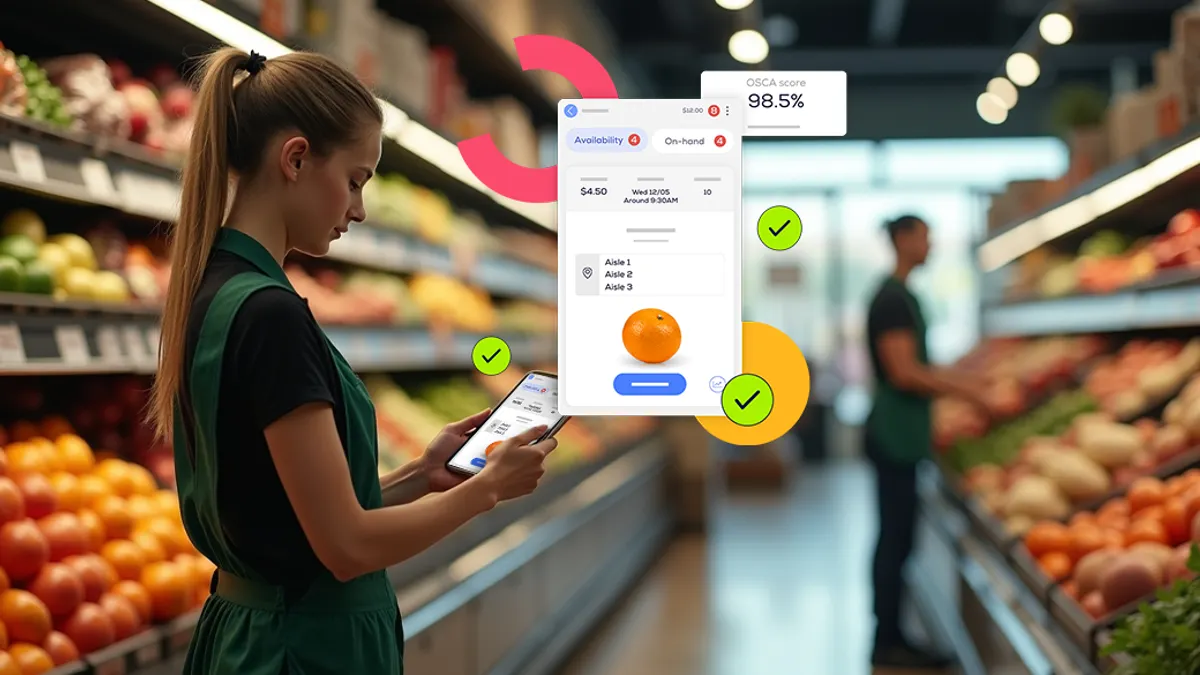

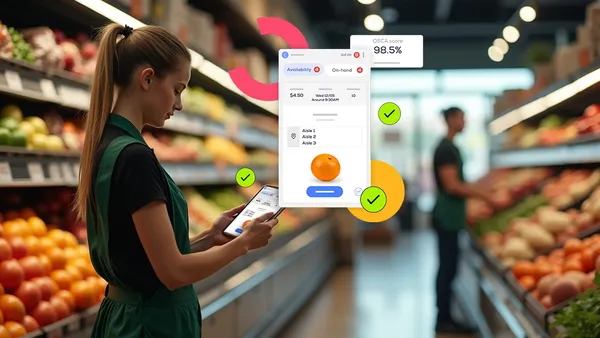

At its core, grocery operations come down to people, products, and places. Associates are being asked to do more with less, and their expertise and attention are finite. A store with 150,000 SKUs cannot expect staff to intuitively know where to intervene; they need real-time guidance that surfaces the next best action. When teams are directed to the right task at the right moment, such as correcting a phantom out-of-stock, clearing aging produce, or executing a markdown with accuracy, the result is measurable improvement in sales, shrink, and customer satisfaction. This frees employees to focus on higher-value tasks and improving overall store performance.

That is why “intelligent tasking” has emerged as a differentiator. Instead of analyzing more data, leading grocers are acting faster with prescriptive insights that prioritize what matters most. Unlike heavyweight digital overhauls that take years and major investment, lightweight solutions that sit on existing infrastructure can unlock value within weeks.

With a top U.S. grocer, our work layering actionable insights onto handheld devices associates already used produced immediate productivity gains, with millions saved through better availability, waste reduction, and improved execution. These tools created tangible wins, including increased shelf availability, reduced spoilage, and smoother operations, while also building trust and confidence in the technology. This feedback loop encourages employees to engage with the insights, creating a culture where success drives further success.

Technology for Real Results

Of course, we can’t have these conversations without addressing AI. It’s dominating headlines, demos, and investment roadmaps across retail. My advice: resist the temptation to chase hype cycles. The biggest wins are not coming from flashy projects but from what we call “quiet AI”: technology that quietly unlocks hours of productivity by embedding models into workflows that help stores make better day-to-day decisions. When AI sharpens a markdown decision, flags a hidden inventory gap, or eliminates hours of repetitive labor, it compounds quietly.

Most AI spending has failed to show ROI because it doesn’t take into account the realities of store operations. Black-box models quickly lose the trust of employees, who are the very people needed to execute on insights. At Retail Insight, we take a different approach. Through cognitive technology, we combine AI, advanced analytics, and deep retail domain expertise into hybrid solutions that augment (not replace) human judgment. This ensures insights are transparent, actionable, and trusted on the ground. It’s why our tools are already delivering tangible results to more than 50,000 stores worldwide. Consistently, customers have realized up to 60x ROI by addressing issues like waste, inventory accuracy, and store execution through focused, explainable solutions rather than hype-driven experiments.

Take waste, for example. Grocers must consider the right product in the right place at the right time, but the volume of fresh items and variability of demand make that a constant challenge. Our waste insight product uses predictive analytics to identify stock at risk of expiring and recommend effective interventions, combining machine learning with domain knowledge to help stores move perishable items faster, reduce shrink, and protect margins.

The same applies to inventory productivity. When AI highlights a phantom out-of-stock or flags a slow-moving SKU, it's not enough to push an alert; the solution must guide staff to the next best action. Retail Insight's technology delivers actionable insights in real time, enhancing human judgment instead of overwhelming it with dashboards. That's why our customers consistently see measurable gains in shelf availability, reduced spoilage, and improved employee morale.

Speed to value is another differentiator. Large-scale digital transformations can take years to pay off, but our lightweight tools integrate with existing infrastructure and start showing results within weeks. Early wins build credibility with staff and confidence with leadership, setting the stage for long-term innovation rather than costly overhauls.

Making Productivity the True Measure of Success

When every cost is rising and every hour of labor is precious, the grocers who win won’t be those chasing the flashiest tech stacks. The advantage will go to leaders who treat data as a scalpel, not an axe, translating insights into action, empowering associates, and keeping shelves full without adding complexity. Over the next year, productivity will become grocery’s defining KPI. The grocers who stand out will not have the most AI, they will have the most actionable insights.