Leslie G. Sarasin is the president and CEO of FMI — The Food Industry Association, a trade association advocating for a safer, healthier and more efficient consumer food supply chain.

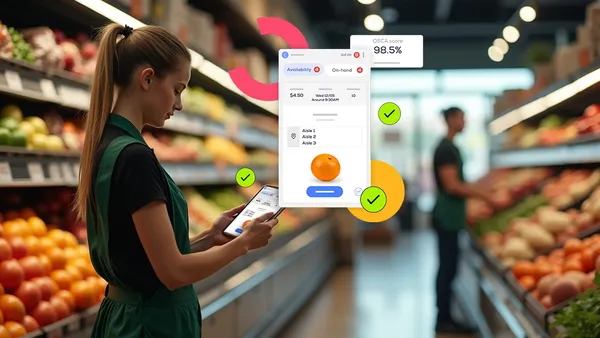

Through leveraging technology, grocers and manufacturers are shaping the food industry of tomorrow with modern business operations and workforce solutions fueled by data analysis and artificial intelligence. Overall, the food industry is creating an innovative and customer-forward grocery shopping experience to meet the needs and desires of consumers with a convenience they can rely on.

A key area of investment is e-commerce, which is becoming a larger part of the overall food retail sales picture every day. The Food Retailing Industry Speaks 2025 report from FMI – The Food Industry Association found that the total share of grocery sales conducted through e-commerce increased from 6% in 2023 to 7.1% in 2024, and most grocers reported that their overall e-commerce business is profitable.

The food industry is determined to meet consumer demand for a more convenient shopping experience, whether that’s in-store, online or for pickup. Today, 85% of food retailers reported conducting online sales, a significant increase from the 50% who reported online sales prior to the COVID-19 pandemic. The retailers engaged in e-commerce offered an average of more than 28,000 items online in 2024. Online transactions averaged 113,294 per week last year for food retailers, with the average purchase size totaling $108.

Investments in e-commerce impact business across grocery departments. Dry grocery remains the most frequently purchased online food variety. However, fresh or perimeter departments, along with frozen foods, represent almost half of online sales, largely concentrated in produce, meat and dairy.

From recent investments in refreshed assortments to new partnerships, ongoing efforts to strengthen e-commerce approaches are paying off for food retailers. These investments include increasing the allocation of staff to support e-commerce operations, growing the workforce for online fulfillment, offering additional products online and emphasizing the focus on fresh or perimeter departments.

In fact, the majority of food retailers with online sales saw an average 15.6% increase in these sales over the last year. This growth is most impressive when considering that, in 2023, most food retailers reported an average 11.3% decline in online sales. This represents a nearly 30-point year-over-year swing and demonstrates the impact of dedicated, thoughtful investments in areas where consumer demand is strong and growing.

Beyond e-commerce, most retailers and all suppliers surveyed for the Speaks report have incorporated data analytics for activities such as pricing and promotion to better serve value-conscious shoppers as well as for assortment planning and replenishment. Additionally, nearly half of grocers and almost all suppliers are employing AI to increase efficiency. Other technology investments include fraud protection assistance, mobile checkout systems, product traceability and planning for fresh inventory and demand or production.

All these investments have one common goal: improving efficiency so that grocers and manufacturers can focus on best serving customers, just as they did during the COVID-19 pandemic. When the world was met with the unpredictability of the pandemic, grocers responded with efforts to ensure that people in the U.S. remained fed amid supply chain shortfalls and adjusted to contact-free transactions during this unprecedented time. Investments in technology expanded into investments in people – retaining, recruiting and supporting those working within stores so retailers could meet customer demand during challenging times.

In 2022, most retailers and suppliers reported that recruitment and retention issues negatively impacted their business. The tumult of the pandemic caused similar challenges across many industries, and the grocery sector was not immune. To address these concerns and create a modern supermarket experience for consumers, the industry made investments in competitive wages, improved benefits, flex time, training and skill development.

In Speaks 2025, nearly all retailers and suppliers reported offering competitive wages and salaries as strategies to improve hiring and retaining full-time employees. Others reported retention efforts such as employee wellness programs, mental well-being resources and education programs and benefits.

In previous years, retailers reported challenges with workforce development and training due to the high costs associated with these programs, which can cost more than $600 per full-time employee. Nearly half of grocers predict these costs will remain constant in the year to come, while half expect an increase in costs for training programs. Despite the expense, grocers experienced fewer challenges with workforce development last year than in previous years.

In short, workforce development efforts have paid off.

Last year, the industry's concerns about retention and recruitment significantly eased. About half of retailers and some suppliers still reported challenges, but overall, the sector saw a notable improvement in reducing employee turnover—bringing rates closer to pre-COVID-19 levels. In 2024, retailers reported a 48% employee turnover rate, down from the 2022 level of 65%. The turnover rate among suppliers is now at 13%.

Initiatives to onboard and retain employees have successfully bolstered retailers’ workforce. In 2023, the industry estimated there would be 500,000 job openings across all U.S. grocery stores in 2024. However, the industry reported approximately 200,000 job openings at the end of the year. That amounts to an average of 1.5 full-time and 2.8 part-time open positions per store nationwide.

Of course, there are still uncertainties ahead. While it is unclear how current immigration and trade policy changes may affect the industry, almost half of retailers and suppliers predict that immigration policy will impact pricing and supply chains. Whatever challenges arise, the food industry will continue to adapt and invest in the supermarket experience of the future.

Industry investments require time, dedication and careful analysis to ensure consumers have a modern, adaptable and convenient shopping experience. In the forever-changing business environment of the food industry, retailers and suppliers are prioritizing a technologically efficient and robust workforce that consumers can rely on today, tomorrow and for years to come.