Kiggins Frosted Toaster Tarts vs. Pop-Tarts. Mantia’s Rising Crust Pepperoni Pizza vs. DiGiorno. Customers may be more familiar with the national brands, but Save A Lot wants them to opt for the private label versions.

“Tastes Alike. Saves A Lot,” says a new ad showing the private label products muscling out their mainstream competitors.

The discounter’s newly launched ad campaign, “A Lot Alike,” comes during a time when customers are feeling the strain of sky-high inflation and gas prices, and highlights the growing role private label assortments are playing in connecting with shoppers.

Seeing its moment to shine, Save A Lot is spotlighting its private label selection in order to draw new shoppers and familiarize customers with its own brands, which comprise 70% of its sales. It also wants consumers to consider its private label selection as on par or even better than national offerings.

“When it comes to food, it's all about taste, and that's what the consumer is making their pocketbook decisions based off of: Taste and value,” said Tim Schroder, the company’s chief sales and marketing officer.

The ad campaign not only focuses on lowering shoppers’ grocery bills but also builds on the discounter’s "Like, A Lot A Lot" campaign last summer, which emphasized its recently refreshed branding and value proposition, Schroder said.

The new campaign, which kicked off on Sunday, features 15-second ad spots for food and general merchandise items on streaming TV services, online video, social media and “owned channels.” The campaign is also running in print versions and in stores. Advertising and marketing agency VIA created the ad spots. It’s an ongoing campaign that will change out the featured products on a seasonal basis, Schroder said.

After seeing a decline in basket sizes over the last few weeks, Save A Lot is hopeful the new campaign will juice sales and entice cost-conscious shoppers.

“It’s really all about saving money and stretching dollars and really showing the private label brands represent that great opportunity for shoppers to maximize savings without having to compromise their quality,” Schroder said.

Switch and save

With price-sensitive customers altering where they shop and what they buy amid high food costs and gas prices, discounters see an opportunity to flex their value proposition. Save A Lot is tapping into private label’s reputation as a budget-friendly alternative as shoppers increasingly turn toward store brands.

In a survey of 1,039 U.S. adult grocery shoppers in March, 41% said they bought more store brands than before the pandemic, and among those who said they bought more, 77% said they plan to keep purchasing more store brands in the future, per the Food Industry Association.

That tracks with the Morning Consult’s findings cited by Save A Lot that 43% of adult shoppers surveyed claimed they bought more private label food and beverages in April, up from 36% who said the same for October.

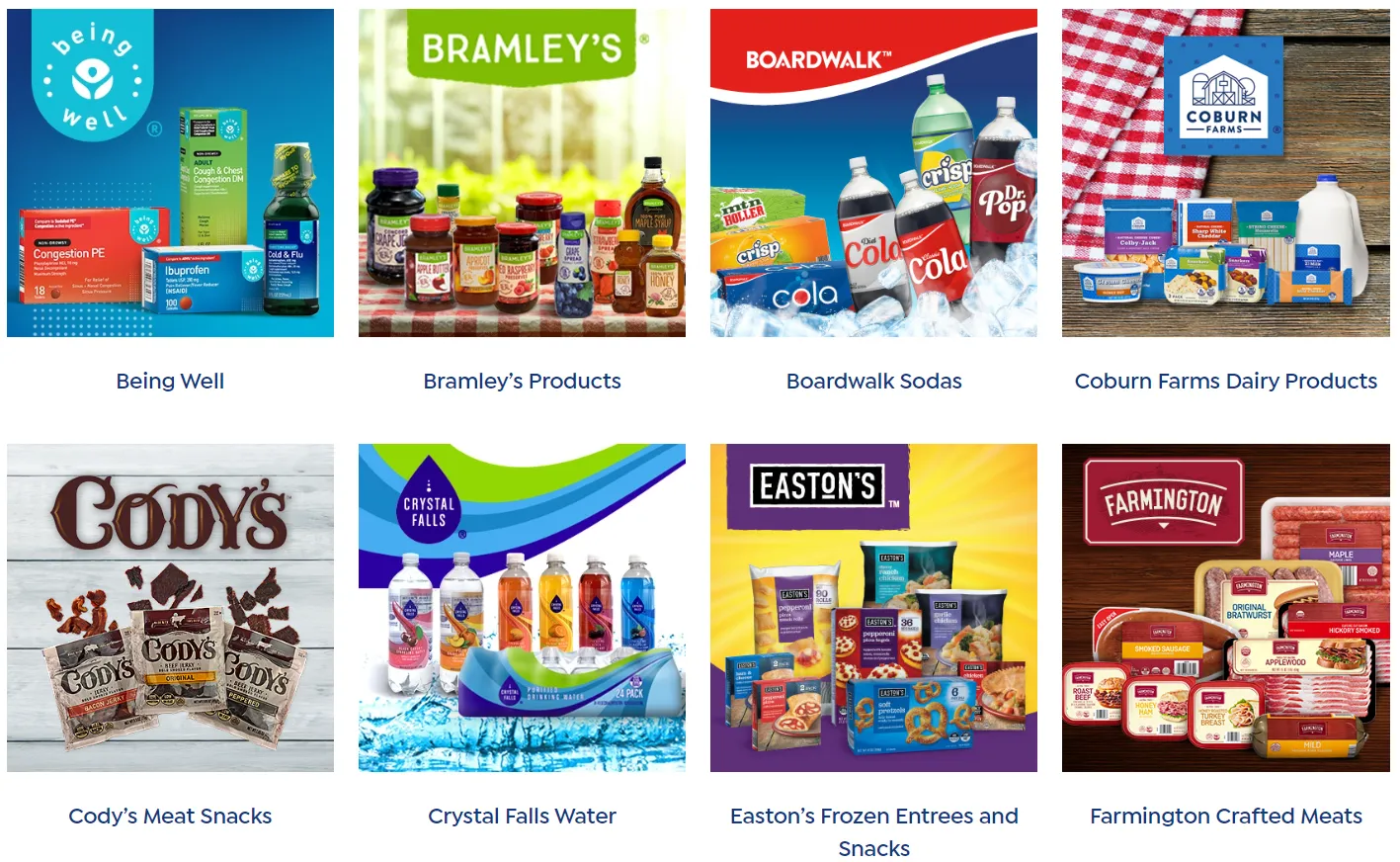

Save A Lot’s portfolio of 55 private brands of nearly 1,900 products is a “key” factor in keeping the company’s costs low. In many cases, private label has twice the margins as national brands, Schroder said.

To pick the items spotlighted in the ads, Save A Lot looks at its sales to find popular items and ones that are “equal, if not in some cases, we believe [are] better quality than the national brand equivalents,” Schroder said.

Proprietary research by Save A Lot gives the discounter insight into the items customers may not see as being the same quality as name-brand equivalents, but are willing to try if the price is right, Schroder said.

The campaign adds to Save A Lot’s recent efforts to entice price-sensitive shoppers. In April, the company launched a pricing promotion that linked meal ideas with the high fuel costs by marketing 10 bundles of ingredients that cost less than the price of 2 gallons of gasoline.

“Sitting here in June, the data that we're seeing tells us that we're going to continue to see challenges through the rest of this year. ... [We] don't expect anything to get better until sometime mid-2023,” he said.

While ads highlighting product attributes often only give vague nods to competitors — like the “leading ordinary brand” language in Bounty commercials — Save A Lot is going a step further by calling out specific name-brand items, many of which are on its shelves. But Schroder didn’t seem worried when asked how the national brands may feel about the call out.

“We're not trying to make a political statement or anything here,” he said. “[We’re] just trying to show the difference in savings from the national brands and the private label brands.”

He continued: “It's no different than Coke and Pepsi wars over the years and McDonald's and Burger King and the Burger King wars. It's fact right now: Private label is cheaper than the national brand equivalent.”

Schroder said many national brands manufacture Save A Lot’s private brands, which, in some cases, are reformulations of the name brand’s flavors and in others, are the “exact same product where they simply just put a different label on the product or our label on it.”

The higher margins from private brand items that benefit Save A Lot also boost the manufacturers as well, he noted.

Spotlighting a fresh look

While some grocers have created strong ties to their private brands, like Costco’s Kirkland Signature line, Save A Lot has taken a multi-brand approach, which its proprietary research indicates consumers often don’t link to the Save A Lot brand.

“In many cases, they don't perceive [the private brands] as the Save A Lot brand,” Schroder said. “Our core heavy, heavy users do. But many perceive our brands as lesser-known national brands or regional brands.”

Schroder credits that perception largely to the private brands’ packaging, which often mimics national brand equivalents.

”Due to our packaging, I think our customers are more willing to try us out when we’re perceived as national brand players,” Schroder said.

Save A Lot started revamping its private label packaging and assortment about three to four years ago as part of a broader brand modernization push. To help spruce up its image, the discounter has embarked on a fleet-wide store remodeling. Midway through 2021, the company sped up its store remodeling efforts with the goal of updating all of its stores by 2024.

Shortly after the remodeling announcement last summer, the discounter rolled out its “Like, A Lot A Lot” campaign with a music video that spotlighted its “fresh shopping experience” and aimed to appeal to younger audiences and create an “emotional connection” with consumers, Schroder said.

The remodels coincided with Save A Lot’s transition to a wholesale business model, which it completed earlier this year, and has boosted sales and customer counts, bringing in both new shoppers and returning ones, Schroder said.

Like the creative campaign last summer to call out its remodeling efforts, Save A Lot’s latest advertising endeavor aims to have its private label grab customers’ attention and more of their wallets, too, with the message that it’s “very similar quality but greater savings,” said Schroder.