As the grocery industry increasingly prioritizes omnichannel experiences and digital innovation, grocers both large and small are restructuring their corporate teams to help drive digital capabilities.

Large players like Walmart and Kroger have been refining their digital teams and roles for the last several years, and now regional grocers are embarking on changes that follow a similar trajectory.

While e-commerce sales growth has slowed following a boom at the onset of the pandemic, sources said they expect online sales to continue to steadily increase in the years ahead, in part due to the shopping habits of younger consumers, said Jason Soar, a former grocery e-commerce lead for Sainsbury's in the U.K. and now partner of retail and e-commerce operational development at The Partnering Group, which has worked on e-commerce with grocers like Southeastern Grocers.

“Grocers of the future would look at e-commerce as [a] business-as-usual function within their core corporate capabilities,” Soar said.

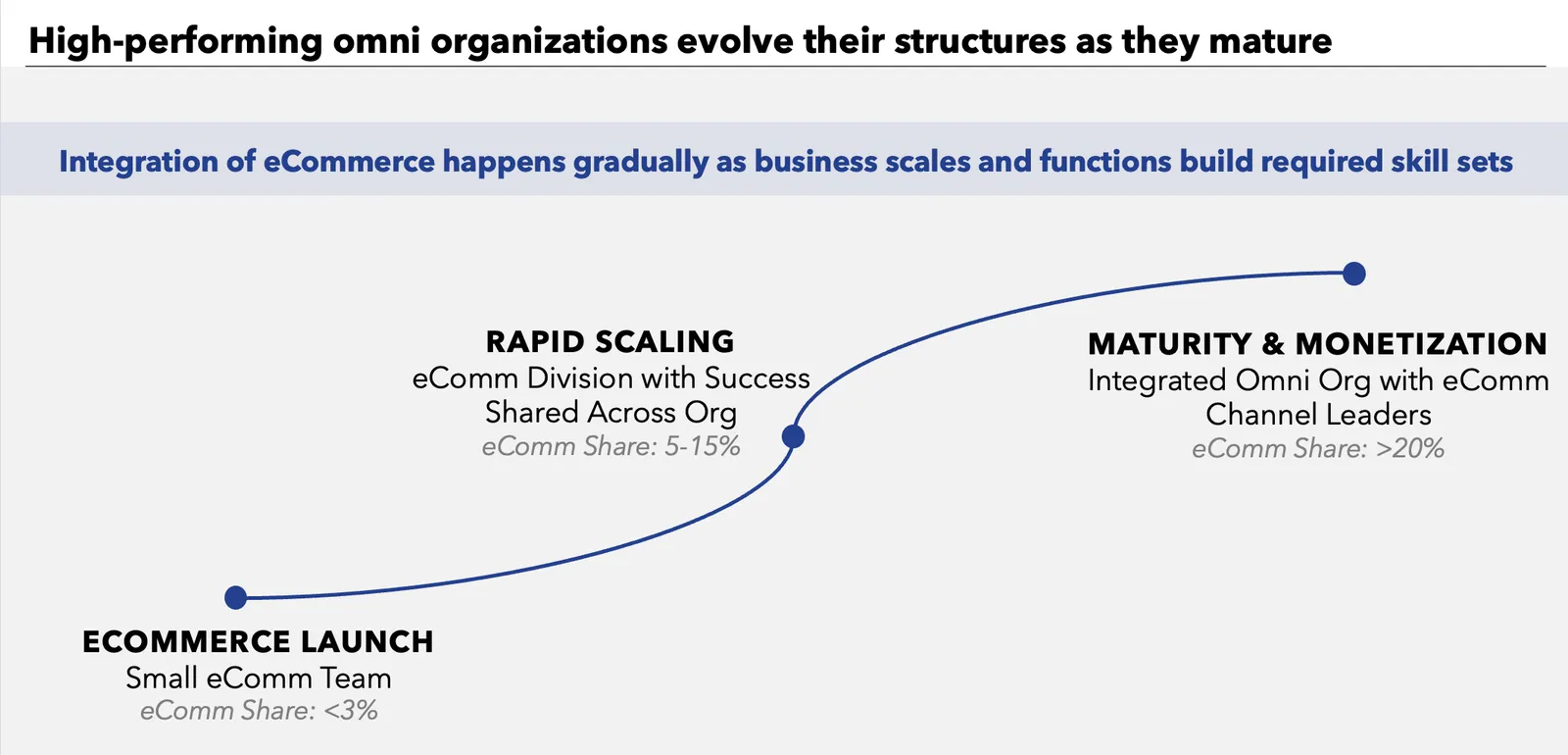

The evolution internally to support more and more digital innovation is less about a retailer’s size and instead more about the maturity of its e-commerce business, sources said.

Grocers with low e-commerce volume — those with sales typically accounting for around 3% or less of overall sales — are fine to rely on marketplaces like Instacart and DoorDash, according to Soar and Jordan Berke, founder and CEO of Tomorrow Retail Consulting.

Most regional grocers have graduated from that early stage, Berke said. The average regional grocer, which has roughly 6%-8% e-commerce penetration, is in the next phase involving scaling that part of its business and embarking on the journey to become an omnichannel retailer, Berke said.

Grocers that are making the pivot away from third-party marketplaces and are now looking to grow their e-commerce business typically dismantle their e-commerce teams and integrate those operations throughout the company, Berke and Soar both said.

Before embarking on internal changes, Soar says grocers need to have their CFOs and finance teams evaluate how using third-party marketplaces impacts their bottom line and customers’ needs and then create a profit and loss statement for the e-commerce business that can help company leaders set a strategic plan for how to develop e-commerce in a sustainable way.

North Carolina-based Lowes Foods, for example, has a digital roadmap that connects to the grocer’s overall strategy, said Tim Lowe, the chain’s president, who stressed that it’s important to follow those plans to guard against “fiefdoms.”

“I always tell everybody, I'm allergic to fiefdoms,” Lowe said. “I hate it whenever walls come up because when walls come up, we don't get to see from the true perspective of what it means to the organization and the business and ultimately what it means for our hosts as well as for our guests.”

What restructuring can look like

Berke and Soar have slightly differing frameworks for how and when restructuring happens.

Based on an analysis of 40 grocers, Tomorrow Retail has found that grocers with e-commerce sales between 5%-15% will typically have a dedicated e-commerce team that includes employees focused on digital merchandising, digital marketing, product and tech guidance, and that partners closely with other functions of the business, Berke said.

Retailers with online sales in the 18%-25% range, though, will typically dismantle that team and take a holistic approach with merchants, marketers and operators that factors in both physical and digital channels, Berke said. Tesco, Walmart and Asda have followed this trajectory, Berke said.

“The first point of integration is store operations so that your stores have ownership over the fulfillment of your e-commerce orders ... they feel like they control the experience, but with that dotted line into your e-commerce leadership so that they're also committed and accountable to enabling economic growth,” Berke said.

Retailers should wait to integrate marketing until e-commerce has scaled enough for that team to be motivated to accelerate digital growth, Berke said. They should also wait to integrate merchandising operations until the e-commerce channel has a big enough impact on this division and until the division has sufficient training necessary to understand how online differs from in-store, he said.

The Fresh Market’s marketing team, for example, oversees both online and offline sales together, said Vincent Yang, co-founder and CEO of Firework, which powers shoppable videos. Having one person or a dedicated team oversee digital innovation, such as The Fresh Market’s Chief Marketing Officer Kevin Miller, makes it easier for vendors to provide digital services to grocers than with those that have siloed teams, said Yang.

“Every vendor will want to work with one person instead of six,” Yang said, noting that this can produce “six very different KPIs that do not align with each other.”

Meanwhile, Soar recommends that regionals transitioning away from marketplaces first shift to a hybrid team, then a dedicated e-commerce team and then move toward omnichannel integration when e-commerce sales account for 15% or more of total sales.

When online sales account for 3%-7%, a grocer can have a hybrid team that is sponsored by a senior-level executive and has “dotted line relationships” with other business units around the corporate head office, Soar said. That team can have one person spearhead the project that leverages business unit expertise.

“If I was going through that transition phase of going from 3% to 7%, then I would be somebody who would have probably come from another grocer who's done this and understands it,” Soar said.

When e-commerce sales are roughly 7%-9%, the next step is to create a dedicated team primarily around operations and commercial finance that can also include merchandising and content monetization, Soar said.

Given the complexities of e-commerce fulfillment, the company may want a role focused on managing different logistics, such as a heavier focus on delivery in cities and pickup elsewhere, Soar said.

“There's so much complexity in e-commerce that where you start isn't necessarily where you end,” Soar said. “It's a constant evolution, as the business kind of grows, consolidates, and then integrates within core business functions.”

Soar said there are two unique functions that are critical to running a lean e-commerce business unit — demand planning and forecasting, and network capacity planning and slot management.

“A few of the skills required in these roles can usually be found in supply chain/logistics functions,” Soar said. “I would place these roles either within Strategy or the Operations/Logistics functions.”

Soar’s corporate restructuring flowchart

Lowes Foods is currently evolving how digital factors into its corporate teams.

Lowe said that when he joined Lowes Food in 2013, the retailer had “half a person” in charge of e-commerce but has since transformed the business to have an e-commerce division, which is headed up by Senior Vice President of E-commerce Chad Petersen.

“[Petersen] has done a great job of structuring the e-commerce organization to where we can look at it as business units and business channels to be able to get us the correct delivery out there and to be able to look at that total interface,” Lowe said.

Now, Lowes Foods is thinking about how that team can move beyond just e-commerce and serve “more and more as a digital Interplay back to our organization,” Lowe said.

“At the end of the day, the consumer, whenever they interact with our brand, what I want them to know is that they're interacting with a brand that cares for them,” Lowe said.

Overcoming restructuring hurdles

Both Berke and Soar cautioned against grocers integrating digital functions too early.

“We've seen one client, for instance, who integrated their merchandising organization when e-commerce was still at about 4% of sales. And what they found is the merchants didn't have the time or motivation to spend any effort on the e-commerce channel and so their growth stalled,” Berke said.

Marketing and merchandising are the most challenging for grocers to blend with digital as they restructure, sources said. Traditional marketing teams have typically had very different KPIs that are more focused on brands and store value propositions, Berke said.

When grocers do blend the digital and marketing teams together, Berke said that omni-marketing teams will often import a digital marketer who has experience driving growth marketing to help infuse the marketing team with a “digital acquisition mindset and culture.”

Finding the right talent is another obstacle: “The e-commerce to omnichannel transformation is a talent pressure point,” Berke said.

Because grocers are often creating new teams and roles for their e-commerce growth, Soar noted that sometimes they don’t know what skillsets or expertise to seek in job candidates.

A grocer that Soar worked with but declined to name, for example, built an e-commerce team that was focused on operations and pulled talent from stores, including curbside leaders. While those hires were subject matter experts, their skillsets were not broad enough to comprehend managing e-commerce as a business unit, Soar said.

“The best case scenario is that talent has already been working on your e-commerce business, but in that small, dedicated team back in the early days, so they know your brand, they know your customer, they know your uniquenesses, but they also have grown up in the digital realm” and are familiar with customer acquisition cost and fluent in how to drive online growth, Berke said.

In a positive sign for grocers, Berke said the grocery industry is attracting more young, digitally fluent talent, in part thanks to the speed, flexibility and willingness to become more digitally nimble when the pandemic started: “We're seeing entry into the industry of people that I think would have never entertained going to a grocery [company’s corporate team]. Grocery before was considered kind of old school.”

Digital innovation leaders also need to be fluent in other areas of a grocer’s business, sources said.

At Schnuck Markets, which is leaning into a culture of collaboration, Vice President of IT Infrastructure and Application Development Dave Steck also touches on loyalty programs, pricing, promotions, marketing and more in his role — highlighting the importance of cross-department knowledge and teamwork, said Anne Mezzenga, Target veteran and co-CEO of retail blog Omni Talk.

“It used to have to be siloed, but now every role, especially in regional grocers, are roles that require exploration and research into automation, into innovation and into other technology investments that weren’t probably part of their job description when they started even two to three years ago,” Mezzenga said.

As Lowes Foods looks to be a smart digital innovator, Lowe said it can be tricky to keep workers focused on prioritizing technologies that fit into the grocer’s digital roadmap.

“One of the biggest challenges ... is to get our teams to not chase shiny pennies,” Lowe said.

He said his philosophy is to “stick to the digital roadmap that ladders to our overall company strategy and then don't chase shiny things. And then work on the things that matter.”

Jeff Wells contributed reporting to this story.

Correction: An earlier version of this story mischaracterized Jason Soar's work Southeastern Grocers.