Entering the retail media space has grown vital for grocers to remain relevant among consumers and competitive in the industry, experts and retailers alike have observed.

And it’s becoming a lucrative alternative revenue stream for retailers. Last year, retail media spend surpassed $40 billion, according to a December eMarketer report. In a more recent report, eMarketer predicted advertisers will pour over $45 billion into retail media ad spending in 2023 alone.

But how does a regional grocer keep up with retail giants like Albertsons, Walmart and Amazon when it comes to wooing advertisers?

To keep pace with national chains, regional players like Northeast Grocery, Save Mart and Sprouts Farmers Market have all launched retail media platforms in partnership with third-party companies like Instacart and Swiftly in recent months.

Giant Eagle took a different approach with the recent launch of an in-house retail media arm, Leap Media Group — something more commonly seen among national retail companies. The regional grocer wanted more control over its media network and, through its myPerks loyalty program, connects with more than 14 million customers via online properties, apps and social media.

“We saw that it just made it so much more efficient for us,” Damian Scott, Giant Eagles’ executive vice president of real media and front end digital, said in an interview. “We run our own marketing for our retail media group.”

Regardless of how regional grocers approach retail media, they are prone to more challenges as they go up against companies with far more reach and resources. So, when entering the retail media space, here are four areas experts said regional grocers should keep in mind to maximize retail media.

1. The need for standardization

For both national grocery retailers and regional grocers, the need for standardized retail media data and metrics is crucial — and a growing frustration among brands, sources said.

Albertsons, which is rapidly strengthening its in-house retail media arm, has been advocating for measurement standardization as well as transparency in how retailers calculate metrics passed on to brands.

MikMak is an example of a software company that provides standardized metrics between retailers and brand partners in addition to offering other tools that help retailers streamline their retail media efforts.

“Not all retailers are made equal in terms of their technology,” said Rachel Tipograph, MikMak’s founder and CEO. “So some of them are managed service businesses, where you literally have to call someone on the phone to try to place a media buy and get reporting. A few of them have actual self-serve analytics. But the reality is, for nearly all [regional grocers] none of that data is in real time. And digital media is a real-time game.”

Tipograph believes that offsite media will rise to become the majority of retail media, complicating standardization efforts even more for brand manufacturers. Currently, marketing teams are purchasing national digital media while sales teams are buying retail media, blurring the lines for brand manufacturers and heightening the need for transparency in reporting metrics, she said.

Standardized metrics are still a significant hurdle for small regional grocers to navigate, Tipograph said, even with companies like MikMak streamlining the process.

Even Giant Eagle, a regional grocer with an in-house retail media network, has turned to third-party companies in order to provide brands, as well as themselves, with accurate, standardized data.

Giant Eagle is managing and executing retail media in-house with the help of partners such as LiveRamp and The Trade Desk, which are “critical to the differentiation and to the measurement piece” of Leap Media Group, Scott said.

2. Scouting talent internally and externally

Regardless of whether a regional grocer has partnered with a third-party company to launch its retail media network or launched independently, talent within the grocer’s house is a necessity.

Melissa Burdick, co-founder and president of Pacvue, another software company that serves as the in-between for brands and retailers in retail media partnerships, said that having an internal team staffed with advisors and a clear retail media strategy is the number No. 1 tool for success, especially for regional grocers who need to more carefully set the “right expectations” for their retail media platform.

Furthermore, it’s those individuals who work for the grocer that will know which partnership best suits the grocer — another challenge regional chains face as online advertising companies continue to grow, Burdick added.

Since the pandemic, Scott stated he has had an easier time not only finding but also retaining talent for Giant Eagle’s Leap Media Group.

“The folks who are more digitally native are much more used to working in a more hybrid environment. And we also want to experience [our platforms] how our customers are experiencing them, so it's helped a lot, especially in our innovation areas,” Scott said.

Even though Giant Eagle is a Midwestern regional grocer, Scott, for example, currently resides in San Francisco while members of his team live in Texas, Florida and even as far away as Canada.

The Save Mart Companies, which recently launched a retail media network in conjunction with retail technology company Swiftly, stressed the value of regional grocers having a third party company to establish a retail media platform with.

Senior Vice President and Chief Digital Officer Tamara Pattison noted that a lot of regional grocers do not have the internal infrastructure nor the digital ecosystem to smoothly launch a retail media company. With Swiftly, the grocer is able to avoid investing “significant dollars in infrastructure internally” and enables its “internal organization to focus on what’s important to us” while Swiftly manages new technologies and engagement models that are “constantly evolving,” she said.

3. Leaning into loyalty

Despite a smaller footprint and typically fewer resources than grocery giants like Albertsons, regional grocers have the advantage of customer loyalty, experts said.

When regional grocers are seeking out brand partners, it is important for them to differentiate not just their business, but also their customer base, Tipograph said. For many regional grocers, they have a very loyal customer base because they serve as the “hometown grocer” and are oftentimes near consumers’ homes, driving shopper frequency, she said.

This is the approach Giant Eagle took when establishing how it would connect with its shoppers. When Leap launched, Scott noted that the platform taps into the grocer’s myPerks data to engage customers.

“[Giant Eagle] has been around for 90 years and this is just changing the engagement and making some of it more digital,” Scott said. He added that by using Giant Eagle’s loyalty program, he isn’t competing with the Krogers or Albertsons in every market.

“We have that entire ecosystem within our market areas. And [retail media] just adds to it,” Scott said, nodding to Giant Eagle’s grocery, pharmacy, fuel and convenience offerings are all included in the retail media platform.

The Save Mart Companies has approximately 200 supermarkets across California and Nevada under the Save Mart, Lucky and FoodMaxx banner, and Pattison notes it has a wide variety of consumers in its small area.

Pattison said Save Mart is able to test new engagement models with supplier partners “in a pretty low-risk way” that “not every retail media network is going to be able to provide.” And she credits this to Save Mart having many types of consumers in concentrated areas.

4. The challenge of scale

A loyal following can only take a grocer so far though, as experts state that the biggest challenge regional grocers will face to stay competitive in the retail media space is scale.

“In the media space, it's about how many impressions can you deliver? How much reach do you have?” said Rob Weisberg, president of incentives and loyalty at digital commerce provider Inmar. “And so the larger players are going to have an advantage in that case.”

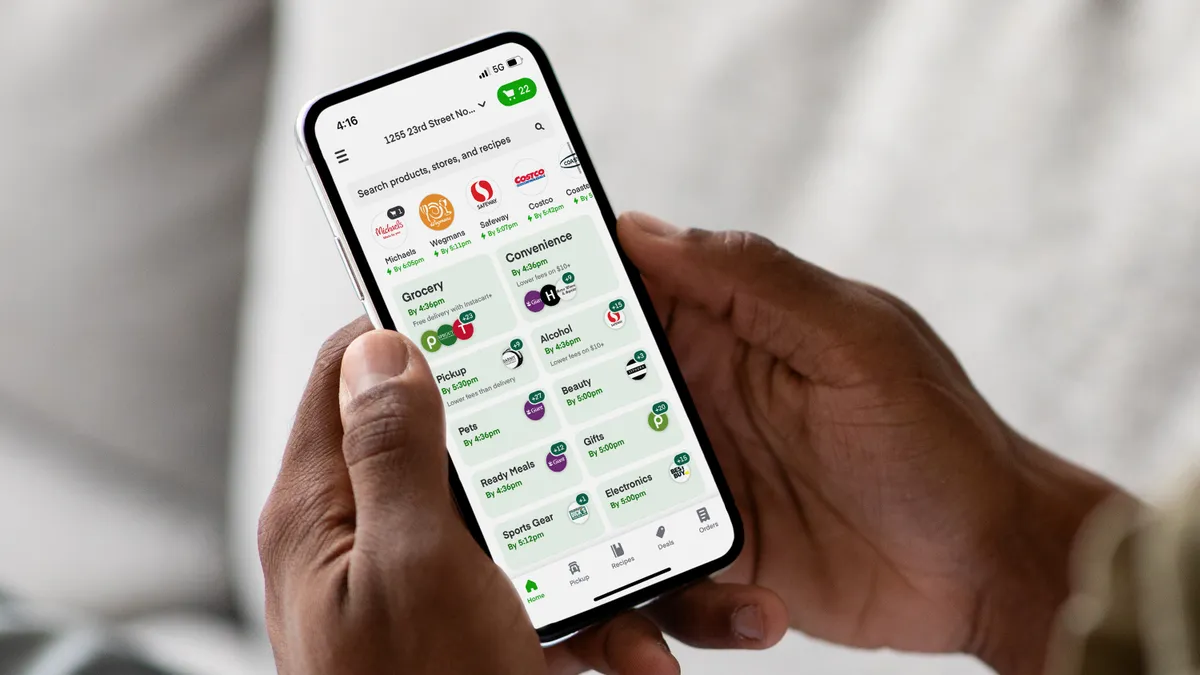

Tipograph suggests regional grocers enter retail media from a consortium approach in order to boost their scale and overall reach of an audience as well as resources. She gave the example of Instacart, a company numerous grocers have relied on to launch retail media platforms, as a way this plays out.

“Instacart is typically the path of least resistance for [regional grocers] to participate in this game,” Tipograph said. “Because what Instacart has been able to do is aggregate thousands of retailers right across this country and aggregate millions of Instacart subscribers to participate. And that’s what you need to compete.”

Burdick also believes scale is the greatest challenge for regional grocers. Brand partners also struggle in these partnerships due to having to put more work into an advertising campaign with a regional grocer that has fewer capabilities.

She said that brands could use regional grocers as “test-and-learn” opportunities to understand what works in an ad campaign and get starter metrics, but noted that many of those brands are already working through CitrusAd and Criteo, popular online advertising companies that a number of brands, as well as regional grocers, utilize.

“I think that there’s probably an opportunity for [regional grocers] to play, but the current playbook of retail media is not effective for them,” Burdick said.

Sam Silverstein and Jeff Wells contributed reporting to this story.