Dive Brief:

- Kroger announced some big changes to its executive lineup, naming Yael Cosset, the chain’s chief digital officer, as the successor to executive vice president and CIO Christopher T. Hjelm, who will retire on August 1, 2019. Cosset will assume responsibility for the Kroger Technology function in addition to his current Kroger Digital portfolio – underscoring the brand’s continued focus on using digital tools to capture consumers’ attention, according to the company.

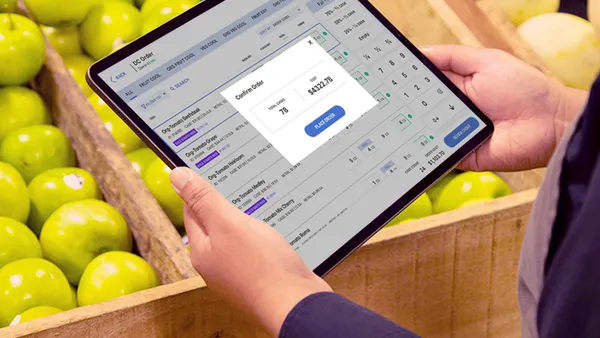

- Cosset was elected group vice president and chief digital officer in January 2017, where he has been leading Kroger's digital growth strategy. Hjelm was instrumental in developing some of Kroger’s new tech-focused elements, a news release noted, including Scan, Bag, Go; ClickList; QueVision and most recently the company's digital EDGE shelf technology.

- Kroger also appointed Stuart W. Aitken to the newly created role of senior vice president, alternative business, effective February 3, 2019. Aitken was elected group vice president in 2015 and has led Kroger's data analytics subsidiary, 84.51°, as its CEO since it launched in 2015. He has served as chief marketing officer since 2017.

Dive Insight:

The country’s largest supermarket is pushing forward in its ambitious Project Restock and making another series of executive leadership changes after shuffling its branding and merchandising leadership in August 2018. Also, it’s chief financial officer J. Michael Schlotman recently announced his plan to step down in April 2019 after serving as one of the chief architects behind the industry's leading analytics service.

Last week, technology veteran and digital services company Conduent CEO Ashok Vemuri joined Kroger’s Board of Directors.

Technology and alternative revenue are two key focal points for Project Restock, in addition to trying to reach a broader range of customers across a larger geographic area. The company has identified alternative businesses as playing a large role in hitting its goal of boosting its earnings before interest and taxes by $400 million to $3.5 billion by 2020.

As part of the project, Kroger has rapidly taken on a wide variety of enterprises. The chain recently partnered with Microsoft to sell store technology to other retailers. It also announced the opening of mini grocery outlets inside 13 Walgreens stores, launched a direct-to-consumer shipping service, opened a comfort food restaurant, added digital shelf displays and pushed into new product categories like meal kits, to name a few recent ventures. In September 2018, it launched its Dip clothing line in 300 of its store locations across the US offering pieces that mostly cost less than $19.

Some observers are skeptical of Kroger’s warp speed transformation, raising questions about how the company will achieve its plans to tap into alternative revenue streams. Jefferies & Co. analyst Christopher Mandeville recently wrote in a recent note that executives “still have a lot to prove." He also noted that while Kroger is still early in its digitalization, the details and specifics regarding the economics of the expansion plans remain a mystery.

And while Kroger’s online sales in 2018 brought steady revenue, growth during the first six months of the year dropped 10% compared to its 140% growth during the same period in 2017. It also recently agreed to sell its convenience store brands including Kwik Shop, which make up a large part of its footprint.

It’s too soon to tell whether the company’s lofty transformation will be a success, but the new leadership sure has their work cut out for them.