Dive Brief:

- Ultrafast delivery firm Jokr announced on Wednesday the launch of Jokr Media, its retail media platform aimed at increasing CPG product sales and bolstering the company's margins.

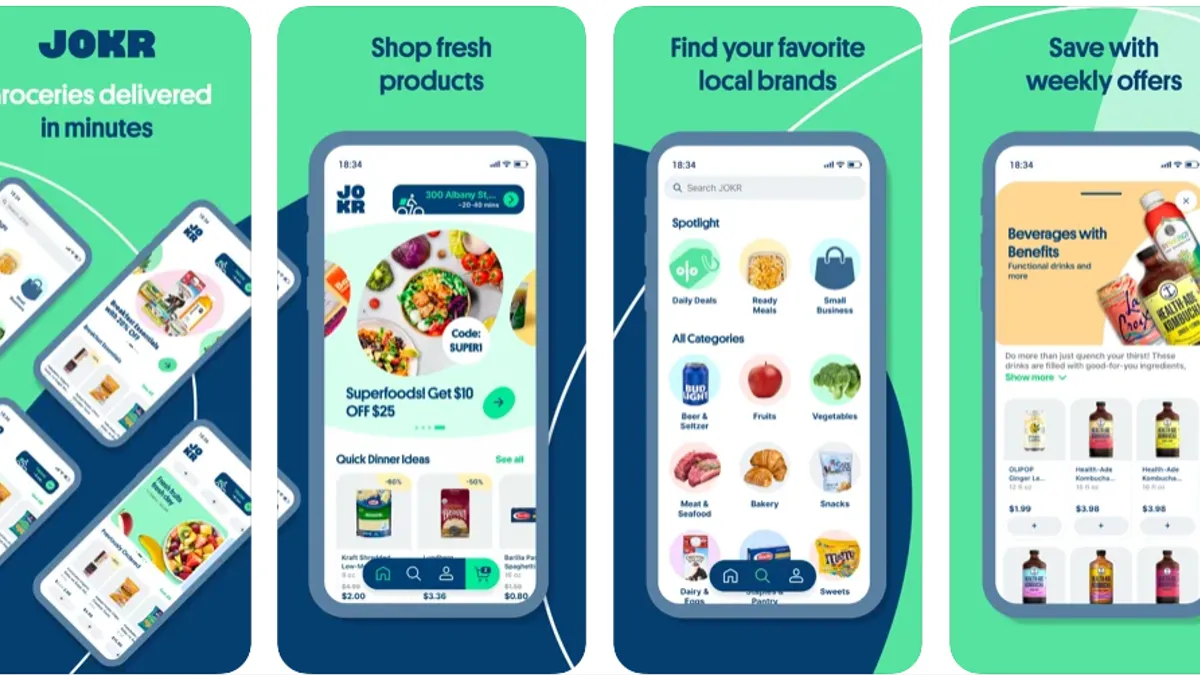

- Jokr also said it's launching a self-service ad platform that will give brands the chance to bid for "more personalized and relevant product placements" in its app. Jokr Media is currently live in the United States and the five Latin American countries where Jokr operates — Colombia, Mexico, Peru, Chile and Brazil.

- Jokr is making its retail media platform a "major strategic focus" as it shifts from its initial expansion phase to focusing on profitability, Benedict Counsell, vice president of onsite and Jokr Media, said in an interview.

Dive Insight:

Jokr is taking a cue from established retailers and branching out into retail media as it looks to shore up revenue for its capital-intensive rapid delivery business.

Jokr Media offers a range of marketing placements and solutions, including in-app banners, sponsorships and sampling. For the soon-to-debut auction-based self-service ads platform, Jokr said it teamed up with ad-auction infrastructure provider Topsort. Brands will be able to select auto-bidding or place bids and manage campaigns themselves, Counsell said.

The company is leaning into its personalization capabilities and data visibility to brands, particularly the ability to leverage performance tracking, in order to stand out, Counsell said. Jokr has worked with small and large CPGs so far, Counsell said, noting that smaller brands, in particular, will be able to benefit from the self-service ad platform.

The launch of the retail media platform follows a global pilot that began in November and ran more than 100 paid campaigns for partners such as Kellogg’s, Grupo Bimbo and Pernod Ricard México, according to the announcement. Brands that took part in the pilot gave "highly encouraging feedback," prompting Jokr to double down on retail media, the announcement said, noting that more brands are looking to grow their digital presence as consumer interest remains strong in e-commerce.

"We're very bullish on retail media in general, simply because we do see ourselves as part of this shift as the customer is moving online," Counsell said. "[Advertising] spend will also move online."

The company sees this as a win-win-win to boosting personalization and relevance between brands and customers while also providing a high-margin revenue stream.

"It will obviously contribute a good amount of revenue and fairly high margin revenue for us on that journey to profitability, which is quite important," Counsell said.

Leading grocery retailers like Walmart, Kroger and Albertsons are ramping up their retail media businesses, and within the past year, e-commerce providers, like Instacart, DoorDash and Uber, have expanded their ads services for brands.

Other rapid delivery players should follow suit as they look to boost their revenue, margin and profitability, Celia Van Wickel, senior director of digital commerce at Kantar, wrote in an email.

“Retail media is mostly pure profit for retailers and would be the same in the rapid delivery space,” she wrote. “In 2022, profitability is of utmost importance as venture capital is softening and valuations are declining, causing rapid delivery companies such as JOKR to prove the long-term profitability of their business models in the hopes of continued funding.”

When convenience e-tailer Gopuff launched its own retail media platform last June, it noted that its solutions allow brands to plan, buy, measure and manage their ads 24/7.

The instant-needs space that Jokr operates in received billions in funding after the pandemic lifted online grocery sales. But startups have burned through funding as they quickly open sites and offer generous promotions to consumers. The competitive landscape has consolidated in recent months with Buyk, Fridge No More and 1520 going out of business.

As Jokr looks to expand its U.S. presence, Van Wickel said a retail media business, along with other revenue streams, can aid the company with its plans to scale.

"Advertisers are seeking strong conversion and data when sales volume is not an option. As these companies are relatively small, sales volume will not be the primary reason CPG advertises," Van Wickel said. "JOKR and rapid delivery companies have the opportunity to provide data transparency to advertisers that they are desperately seeking. This will make their media network most attractive."

The new retail media network is the latest innovation from Jokr. Earlier this spring, the company launched a new mobile app with automated content curation to personalize the shopping experience and announced it linked up with Plan A, a German software development firm, to help achieve carbon-negative grocery delivery.

These efforts come on the heels of a $260 million Series B round at the end of last year that raised Jokr's valuation to $1.2 billion and followed a $170 million round over the summer.