Dive Brief:

- Instacart announced Thursday it plans to offer automated fulfillment as a service to grocers in the U.S. and Canada, and that it has signed a multi-year deal with technology firm Fabric as part of the endeavor.

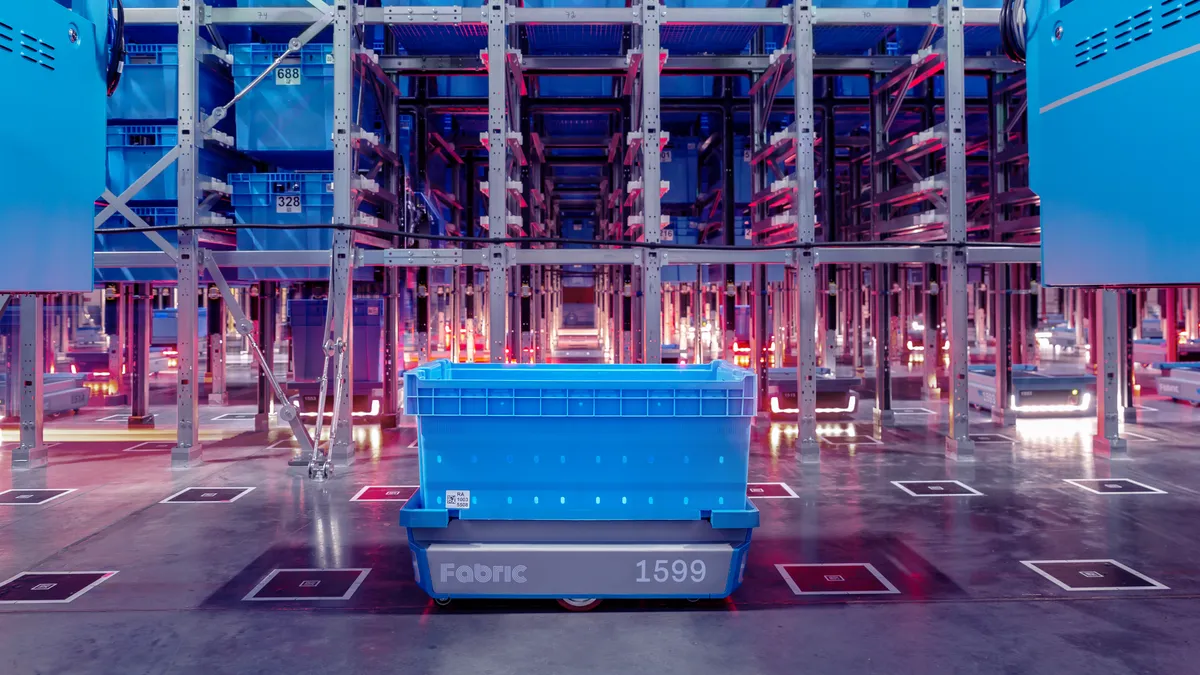

- The service will combine Fabric’s software and robotics with Instacart’s proprietary technology and gig shoppers for fulfillment inside separate warehouses and existing stores, according to the announcement. Instacart said it plans to announce its first retail partnership within the next year.

- The announcement marks the first move for Instacart beyond its legacy store-based fulfillment — a major step for the company as online shopping continues to grow well above pre-pandemic levels.

Dive Insight:

Instacart has finally confirmed news that’s been widely reported this year as word got out that the e-commerce company had issued requests for proposals to numerous fulfillment technology firms.

The addition of robotics as part of its order fulfillment service is a key adjustment for Instacart, made all the more urgent by the pandemic-fueled surge in online grocery shopping. Although its legacy model of sending gig workers into stores still works for many retailers, it’s inefficient at high volumes and can clog up aisles and checkout lines with green T-shirt-clad Instacart workers.

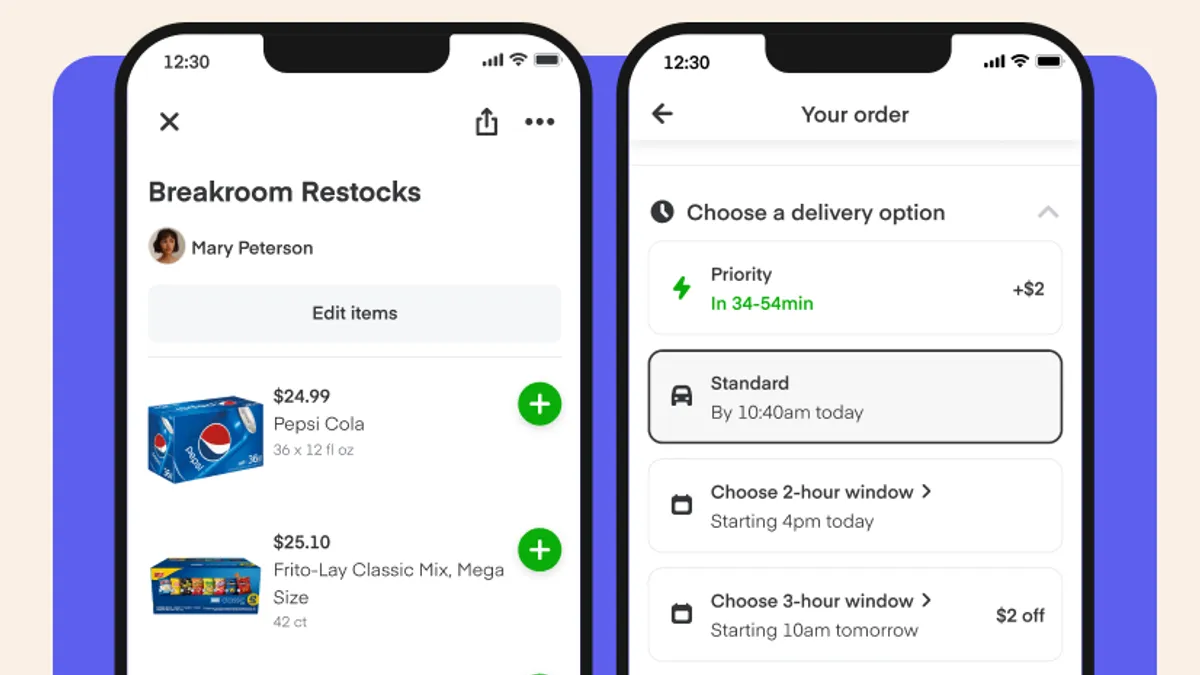

Using technology from Fabric and Instacart, those workers will be able to navigate spaces that are optimized for online order packing, then deliver groceries to shoppers’ doorsteps or to staging areas for curbside pickup.

“This new solution will ultimately enable a faster experience for customers, and help retailers continue to innovate and compete,” Instacart noted in a statement.

Instacart said its partnership with Fabric marks the “first phase” of its new fulfillment initiative, and that it will launch early-stage pilots with grocers sometime in the coming year. An Instacart spokesperson declined to say whether Fabric’s deal with the company is exclusive or if other fulfillment providers might also join up in the future. Fabric has also linked up with Walmart, FreshDirect and Israeli supermarket chain Rami Levy to build automated micro-fulfillment centers (MFCs).

The companies didn't provide further information on the size range of facilities, layouts or other specifications. The Instacart spokesperson said the companies will work with retailers to build custom fulfillment solutions. It's also unclear at this point whether the new strategy will eventually incorporate nonautomated spaces like pick zones and dark stores, which retailers are increasingly relying on to fulfill online orders.

Currently, automated fulfillment technology spans a wide range of facilities and formats, from cavernous warehouses like those Kroger is deploying with Ocado to small MFCs. The technology promises to speed up fulfillment and improve service aspects like order substitutions and inventory visibility, since the high-tech spaces are tailor-made for online fulfillment. More efficient service could in turn reduce fees retailers pay to Instacart, currently around 10%, and subsequently what customers pay for their orders.

But questions still surround the use of automation, particularly the MFC model, which is still a very new technology for retailers. Experts say retailers are so far struggling to see gains in productivity and margins that vendors have long promised, which could make those retailers more likely to offload the job, challenges and all, to Instacart.

Some in the industry have speculated that Instacart could use separate fulfillment facilities to sell products directly to consumers, despite the company’s insistence it has no plans to do so.

Going direct would jeopardize so much of Instacart’s existing business while saddling it with inventory, according to sources interviewed recently by Grocery Dive. Still, it remains to be seen how Instacart’s fulfillment strategy will evolve under new CEO Fidji Simo and numerous other recently appointed executives as the company approaches a public offering.