Dive Brief:

- Instacart announced Thursday four updates to digital solutions under its Instacart Platform, noting that the new capabilities are now available to grocers across North America.

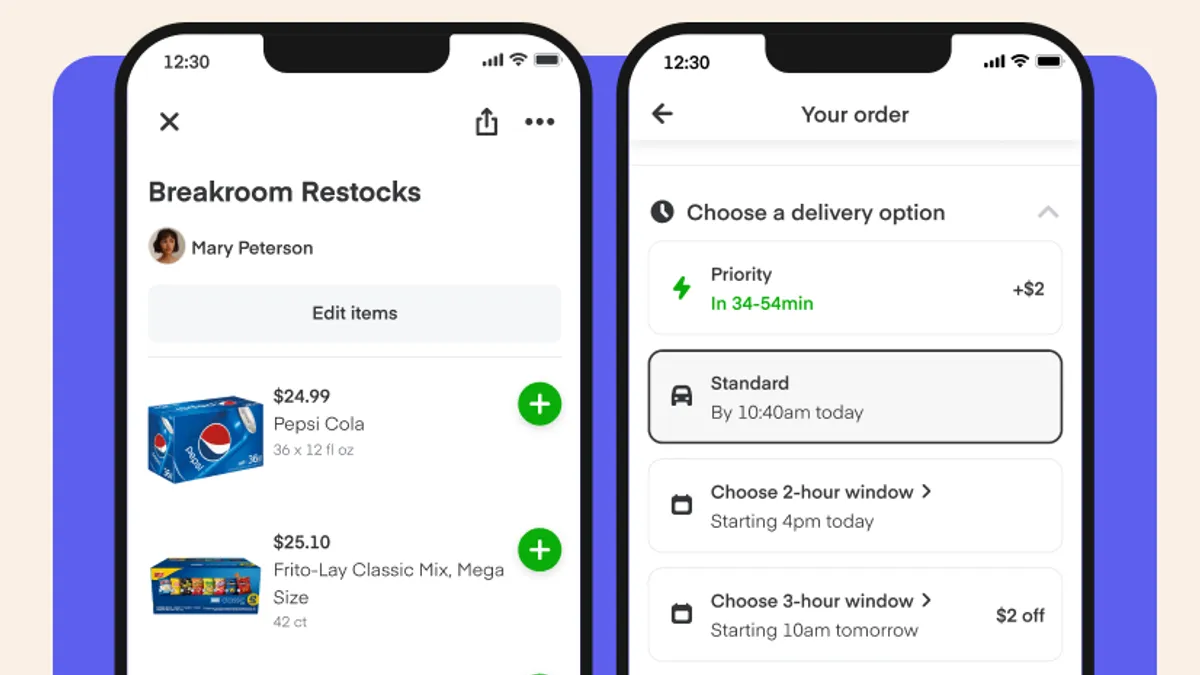

- The changes include allowing grocers to have display ads on their retail media networks powered by Carrot Ads; offering remote management via tablet for Instacart’s smart carts to better support auditing and real-time tracking of shopping behavior; and providing integrated fulfillment for Rosie-powered websites, marrying Instacart’s fulfillment services with Rosie’s white-label e-commerce solution. Instacart has also added items sold by weight, like deli meats and cheeses, premade dishes and salads, for ordering through FoodStorm, its order management system.

- The updates come at a time when Instacart is investing in building out its digital solutions for retailers’ in-store and online shopping experiences.

Dive Insight:

After making its name as an e-commerce provider — particularly for delivery — for grocers, Instacart is ramping up its digital solutions, with this latest announcement placing a heavy emphasis on small grocers.

The press release includes praise from Laura Strange, senior vice president of communications and external affairs at the National Grocers Association, and notes that Instacart plans to showcase these technologies and other offerings at the NGA Show next week in a fireside chat and at a booth.

Nearly half of the announcement is devoted to testimonials about Instacart’s new tools from several wholesalers and small retailers including Niemann Foods and Uncle Giuseppe's Marketplace. The Fresh Market, for example, is using Carrot Ads, while New Seasons Market has tapped the weighted item functionality for FoodStorm and Associated Food Stores uses Rosie’s white-label e-commerce technology.

“We care deeply about empowering grocers of all sizes to serve their customers and communities,” Nick Nickitas, Instacart’s general manager of local independent grocers, said in the announcement. “Instacart is building technology to invest in the future of our retail partners, and we believe that local and independent grocers in particular can benefit from easy, affordable solutions that are built just for them.”

Nickitas founded Rosie, an e-commerce provider focused on independent grocers, and served as its CEO until last September when Instacart bought the company.

The changes seek to bolster options under the Instacart Platform, a suite of enterprise-grade tools the company debuted last year that serves as the umbrella for a variety of offerings, including white-label e-commerce solutions, end-to-end fulfillment, in-store technologies and advertising solutions.

Instacart’s emphasis in the announcement on small retailers is striking, though not surprising, given that those grocers tend to have more limited resources and abilities to invest in building technological solutions in-house compared to large players like Walmart, Kroger and Target.

Instacart is aiming to help indy and local grocers to boost their businesses through innovative technologies. Amazon has taken a similar step in the grocery space, announcing at the end of last the first non-Amazon-owned grocer in the U.S. equipped with its Just Walk Out and palm-scanning technologies.

Instacart has taken several steps in recent months to lean into services and tools for retailers that go beyond its e-commerce fulfillment and marketplace offerings.

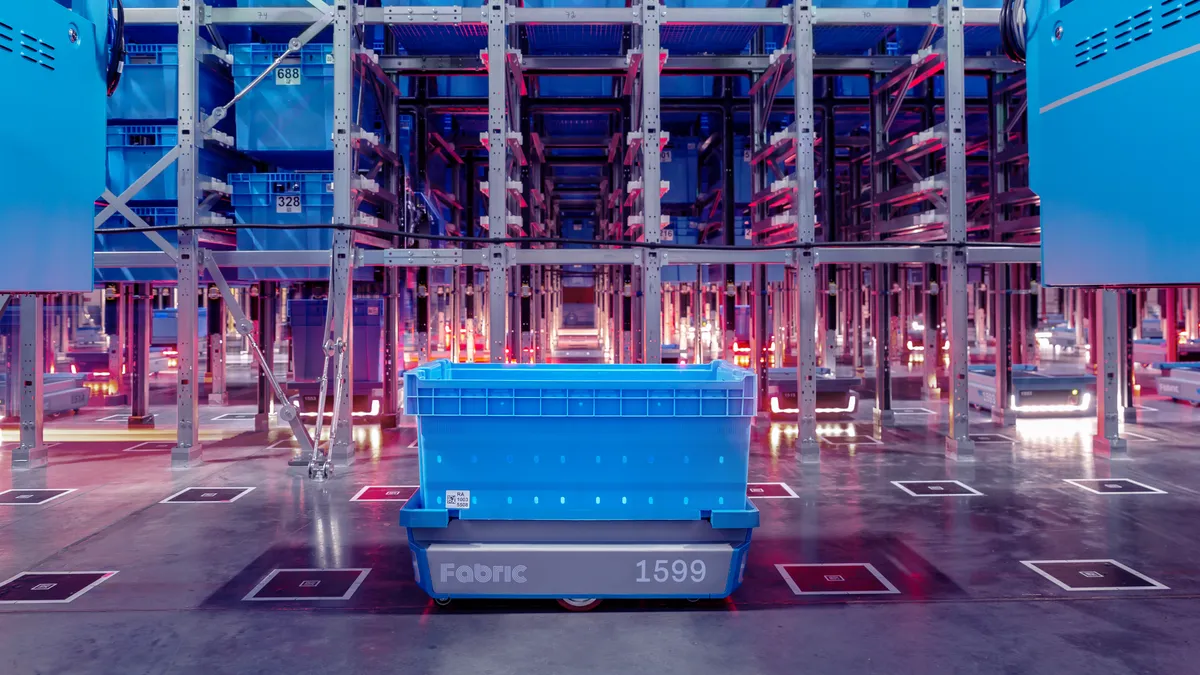

Last summer, Instacart finished integrating FoodStorm, the catering software firm it bought last fall, into its Instacart app. Around the same time, Instacart disclosed that it had bought Eversight, which runs an artificial intelligence-powered pricing and promotions platform. Also in fall 2021, the e-commerce company acquired smart cart maker Caper AI.

Last September, Instacart unveiled its “Connected Stores” bundle of new and existing technologies, such as Caper carts and digital list-making tools for consumers.

At the start of this year, Instacart announced the launch of its Scan & Pay solution at Foodcellar Market, a two-store grocer in New York City.

Experts have said they predict Instacart will lean even further into retailer services to become a one-stop shop for different digital tools, which will likely appeal more to smaller grocers.