Dive Brief:

- Instacart announced Wednesday evening it has filed a confidential draft registration statement with the Securities and Exchange Commission for a potential initial public offering.

- Instacart revealed no further details on its statement on the confidential filing, which allows regulators to review the company’s plans for a possible IPO privately. A public listing could happen this year, according to Bloomberg, which first reported the news.

- The announcement is a long-awaited step for Instacart, which saw business surge during the pandemic but has recently faced declining sales.

Dive Insight:

Instacart has finally taken a major step toward going public. But the possibility of an IPO comes at a challenging time for the company, with its business declining and the stock market plunging amid record inflation.

Earlier this month, Bloomberg Second Measure published data showing Instacart's sales declined 4% during the first quarter of 2022 compared with the same period last year, continuing a downward trend that began in early 2021. In March, Instacart slashed its valuation by nearly 40%, to around $24 billion, after posting a $39 billion valuation last year.

This follows a boom period early in the pandemic when Instacart hired hundreds of thousands of workers, signed up new retailers and had millions of consumers relying on its delivery service.

Filing confidentially for an IPO gives the company flexibility around when, and if, it decides to go public. It also prevents competing companies from seeing its financial information as regulators review the filing. If Instacart does ultimately decide to go public, it will have to file an S-1 registration a few weeks before the offering.

Founded in 2012, Instacart has had a turbulent corporate history that has traced the growth of online grocery in the U.S. After Amazon acquired Whole Foods in 2017, Instacart capitalized on the rising fear among food retailers that they were behind the ball in e-commerce. It signed up dozens of chains for its delivery and platform services, including top names like Kroger, Albertsons and Publix. During the pandemic, Instacart experienced soaring sales as its ranks of contract delivery workers climbed to more than half a million.

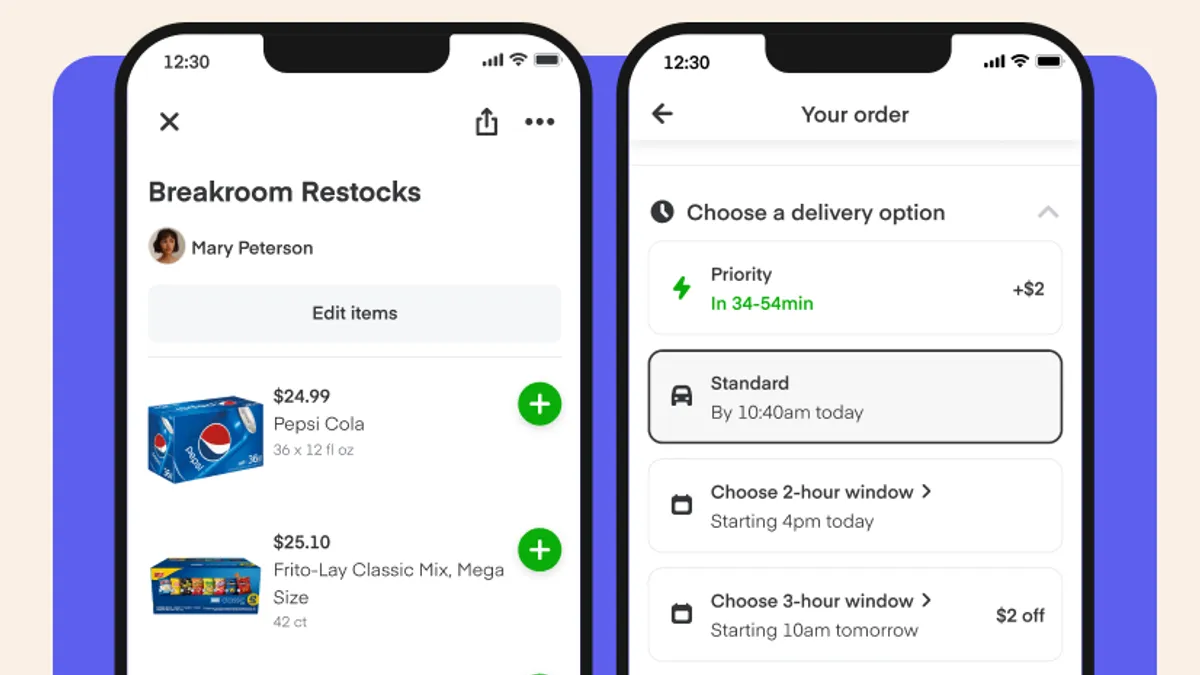

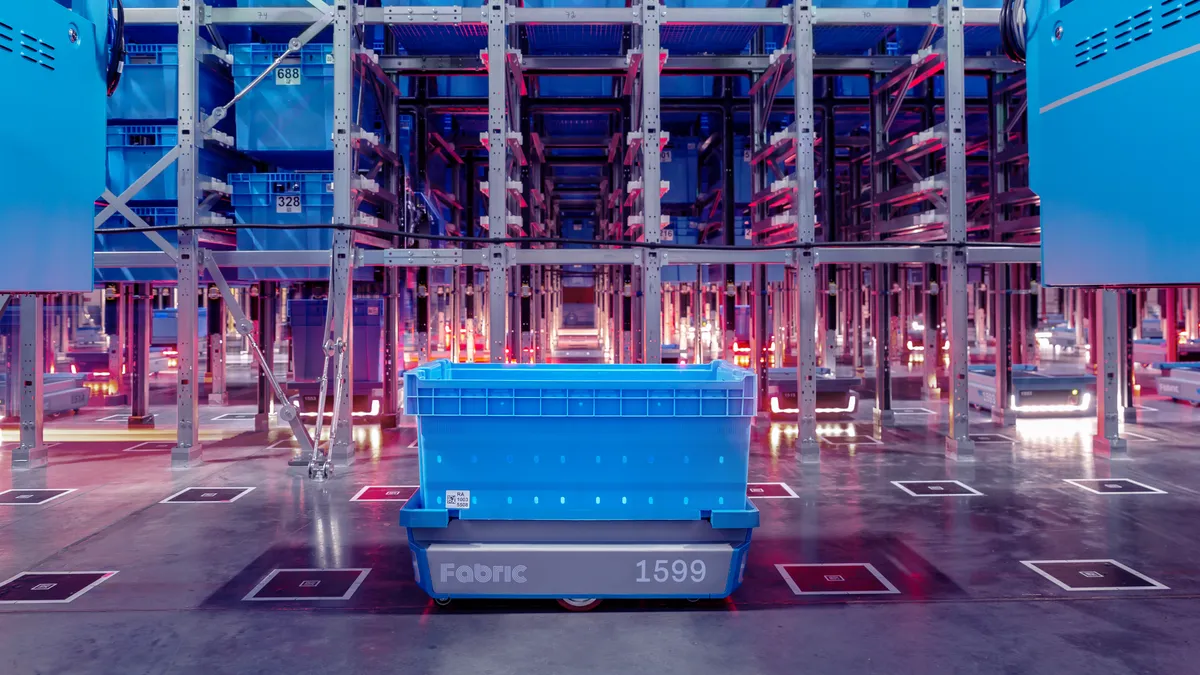

But shadowing that growth has been an uneasy relationship with many of its grocery clients, which have chafed at Instacart's rising profile, how it collects consumer data and other issues. As its sales have declined over the past year or so, the San Francisco-based company has expanded its stable of retail services in an effort to remain relevant with grocers. Earlier this year, Instacart unveiled a brand refresh and soon after launched Instacart Platform, a suite of services for grocers that includes in-store technology, advertising capabilities and a fulfillment service called “Carrot Warehouses.”

Instacart is also facing much more robust competition these days — primarily DoorDash, which has moved assertively to provide delivery and platform services for retailers while moving into rapid delivery. Instacart is also competing with Uber Eats, Gopuff and Amazon for consumer dollars.

Last year, Instacart named Facebook veteran Fidji Simo to replace founder Apoorva Mehta as the company's CEO. The move underscored Instacart's drive to grow its digital ads business, which has taken off as more CPG companies turn to retail media networks powered by first-party data. Instacart hired a rapid-fire succession of other executives across its business. But it also saw some key executives exit, including president Carolyn Everson, who left the company after just three months.

Instacart's IPO announcement arrived on the company's 10th anniversary, which Simo marked with a blog post on Wednesday saying that it is “much more than just a company that powers grocery delivery — we’re a grocery technology company.”