Richard Galanti was two weeks shy of his 28th birthday when he left New York City to join a startup retailer named Costco in the state of Washington. He had gotten to know the company while working with them on a Series A financing round as a young investment banker with Donaldson, Lufkin & Jenrette.

It was 1984, a time when it was not an altogether typical career move for a Stanford MBA with a degree in finance from University of Pennsylvania’s Wharton School to walk away from Wall Street. But he took a chance when the company that was just then opening its first three locations in the Pacific Northwest told him their original CFO was leaving and asked if he’d like to come work for them.

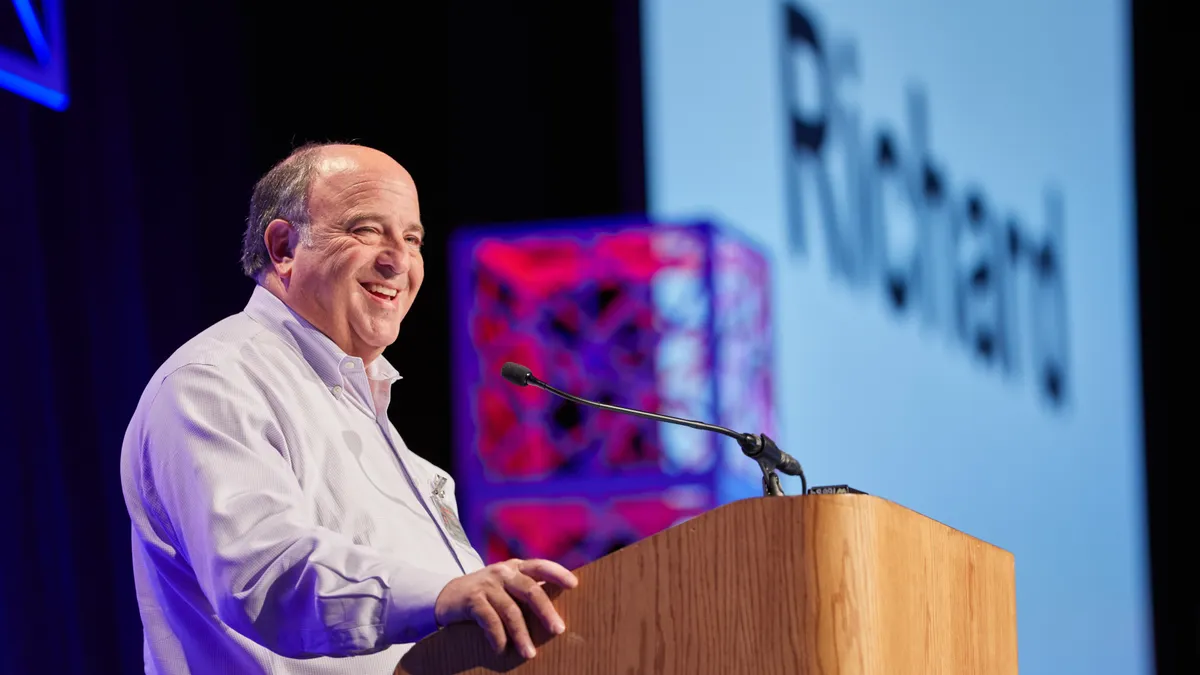

Galanti, now 67, told CFO Dive in an exclusive interview this week that he figured he’d likely be there four years and then return to live “happily ever after” in his hometown of Atlanta. Instead, he is preparing to step down next week after nearly four decades at the finance helm of what turned out to be a retail juggernaut. Costco operates well over 800 warehouses and reported that net income for the 53-week fiscal year ended Sept. 3 rose to $6.29 billion from $5.84 billion in the prior year’s 52-week period.

Morningstar analyst Noah Rohr, noting that Galanti is known as the company’s “voice” to Wall Street due to the many earnings calls he has presided over, credited him with providing good insight into how the business is performing and added that the company typically doesn’t have one-time adjustments in its earnings that would “blur earnings quality” even if it has long avoided giving investors forward looking guidance. “Galanti and the rest of Costco’s executive team have long focused most of their energy on meticulously running the business — providing an enjoyable shopping experience and offering low prices to its consumers — while trusting that financial results would inevitably follow,” Rohr wrote in an emailed response.

In the wide ranging talk looking back at his career and the company’s business strategy, Galanti repeatedly stressed how fortunate he was to have gotten to play the role he did in the company whose story and “folklore” he appears to cherish. “Whenever I speak to students they say, ‘How did you get where you got?,’” Galanti said. “I say, ‘a lot of hard work, which creates more chances and good luck.’”

Editor’s note: The following interview has been edited for clarity and brevity.

CFO Dive: You reportedly got your first taste of the business at your family’s grocery stores. What was that like?

Richard Galanti: It was more of a grocery store than the big supermarkets we have today. Today, the big ones are 50-60,000 square feet, these were 18 or 20,000. Anyway, I grew up in them, my dad and his three brothers had four stores, two grocery stores and two other retail stores. I along with some of my cousins grew up working in the business, you know, bagging groceries when we were kids, stocking shelves and mopping floors. When I got a little older I got to cut meat. Then of course our summers in college tended to be my dad and my uncle’s mini vacations from the standpoint that we kind of managed the store. But there were four stores and fifteen cousins so I never thought I’d be in retail.

CFO Dive: You were one of the youngest executives when you started at Costco. Was that hard?

Richard Galanti: I think having grown up in a grocery store helped. I used to joke that Jim [Sinegal], our founder, liked me not necessarily because of my Wall Street experience or MBA but [because] I grew up in a grocery store and had actually stocked the shelves and cut the meat and mopped the floors. Also, if you think about the first ten or 12 merchants and operators that started Costco starting with the two founders, they were all in their early to mid 40s and most of them came from San Diego, from a company called FedMart. So it wasn’t a startup of a bunch of smart 22 year olds. It was a startup but with people that had been in retail and in big discount and box retail for 20 plus years. Notwithstanding the fact that there were challenges early on in IT and challenges with getting the bills paid, operationally we knew how to run the company.

CFO Dive: I’m sure you’ve had offers to go elsewhere. Why did you stay so long in the CFO role, which some view as the number two or “wingman” position?

Richard Galanti: Years ago our founder, my boss for the first 28 years, said if I ever wanted to be considered for a role other than the CFO I’d have to go work in operations. Frankly I enjoyed my job, and in a way while there is travel involved in my job, I wasn’t traveling three weeks a month like many people in merchandising and operations have to do. I guess I was a little spoiled in that regard as well. But certainly I had no problem with being number two or three or four in a company that is such a wonderful company with great people.

CFO Dive: Did your family play a role in that, not wanting to be on the road all the time?

Richard Galanti: Well, my dad worked six days a week in the store and came home after dinner two or three nights a week so he worked hard but he was in town. I don’t know, maybe that’s part of it. But again, you look back, you say nothing could have been planned. When I think about it, the two founders of Costco went to New York to interview three or four boutique Wall Street firms, fortunately for me they picked DLJ, fortunately for me, I was available to work on it.

CFO Dive: People talk these days in the CFO world about classic CFOs versus strategic CFOs with the classic typically being a CPA. Where do you feel like you fit in there? (Note: Galanti is not a CPA)

Richard Galanti: I hate to use the word strategic. It sounds a little fancier than I am. I’d probably lean a little more toward classic. Certainly I’m part of the team. Ultimately the merchants and the operators come up with many of the ideas. But nobody has a monopoly on that and over time we all work together. I think the role of the CFO starts with the basics of, [you] learn the traditional functions under the CFO at a sizeable company, the entire accounting function, both all the financial statement preparation plus all the information tools that are used by the people in the company. You’re providing timely, accurate and useful information to the buyers, to the warehouse managers, to the people that run our manufacturing businesses.

CFO Dive: What was the hardest time being CFO for you?

Richard Galanti: I think COVID was up there for a lot of reasons. It impacted everybody personally. It impacted your employees in different ways and it impacted our operations of course. With all the challenges of supply chain and shortages of of containers and shipping and not knowing where the merchandise was and not knowing what impact it would have on our business. In March or April of 2020 we, like many companies, as strong as a balance sheet as we had and still have, we went out and borrowed an additional $4 billion not knowing what that spring, summer or fall would bring.

CFO Dive: It’s been said you’re good at pointing out patterns. Is that one of your strengths?

Richard Galanti: Usually from an investor relations public company standpoint it’s the CEO who is the one on the phone and the CFO is providing more of the financial stuff and the CEO is talking about direction or whatever else. Here, from Jim to Craig [Jelinek] and now Ron [Vachris] generally speaking they’ve said, ‘you go do that, I’m running the company.’ I’ve done it with consistency, transparency and straightforwardness and not over-promising. I’ve always tried to not just regurgitate the numbers but give them trends. While we don’t provide any forward looking statements, we won’t do that, we try to respond to the likely questions we’re going to get.

CFO Dive: You said you would hold the soda and hot dog combo at its $1.50 price potentially “forever” to emphasize value. Given that you’ve said you don’t like to over-promise, can you stick with that?

Richard Galanti: Look, that’s certainly our goal. We went out years ago and built a hot dog plant that makes two items, the big hot dog that we sell one at a time and then 12-packs or 10-packs of a smaller size for families. That’s a plant that makes 300 million hot dogs a year and we did that to take a few cents of the cost out by doing it ourselves in such huge efficient volumes and to try to keep that price lower. It’s become part of our folklore, both of those items you mentioned [the hot dog combo and the $4.99 rotisserie chicken]. In terms of changing prices those will be two things that would be last on the list and I don’t see it happening in the near-term.

CFO Dive: How involved are you in pushing efforts [such as keeping health care benefits costs down for employees]?

Richard Galanti: We’re all involved in pushing it because we understand the goals of the company and this operating framework we’ve talked about from the beginning here. I think part of my job is, I’ve been a good communicator, particularly when Wall Street says, ‘why don’t you charge more for that item.’ Because that’s not how we do things, we try to figure out other ways to do things. It gets back to that discipline. Now, one can only be so noble. If you’re not rewarding the shareholder, none of this matters because you’re not going to be around to manage the company.