Sampling can elevate the in-store experience and encourage shopper discovery — not to mention customers love it. But translating this to online grocery shopping has proven tricky.

Adding samples to delivery and pickup orders can be an impersonal experience, with consumers sometimes not knowing why they are receiving an additional product.

But grocers haven’t given up on cracking online sampling. Stater Bros. Markets, for one, is using online sampling as a chance to learn about their shoppers while providing them with relevant goods they’ll likely enjoy.

To achieve this, the grocer partnered with Swish in September to establish a program that enables the grocer and its brand partners to carry out product sampling campaigns for online customers.

Swish aims to refine online sampling into a more targeted endeavor and turn it into an e-commerce revenue stream.

“[Sampling] has just been a nightmare for years on the retailer side,” Swish founder and CEO Adam Stave said in an interview. Traditional grocery stores aren’t designed to distribute samples in a measurable or targeted way, he said, given that the in-store setup cannot be accurately or consistently linked to future purchases. As for online, creating sample sizes of products is costly for brands and there is limited feedback on how the product resonated with consumers.

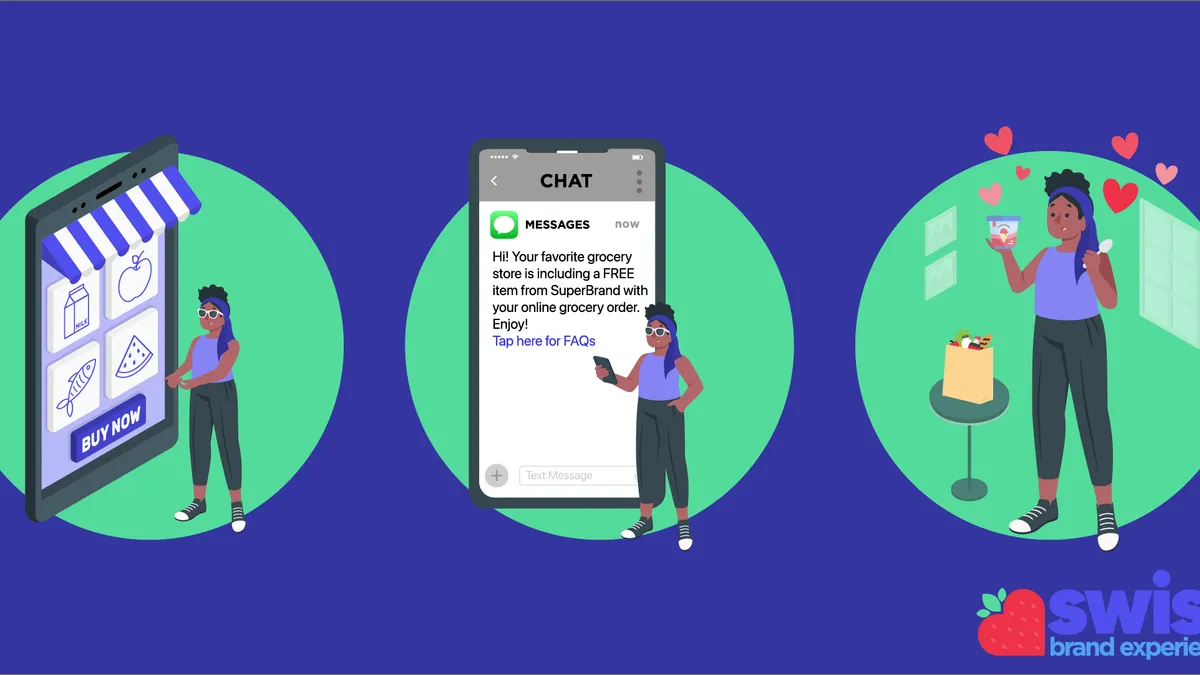

Swish can learn about customers through their online orders and help determine samples. The company’s tech solution notifies brand and grocery partners about an in-stock product that is relevant to a customer’s order or past purchases, Stave said.

“We built [a] programmatic platform that allows brands to say, with a few clicks, ‘Hey, they always buy our spaghetti [but] they never buy our pasta sauce. Let’s give them a $3 garden vegetable pasta sauce next time,’” Stave said.

By working directly through first-party e-commerce, Swish can target the correct customer and track their shopping history to see if they later purchased the free item included in their order.

CPGs are willing to repeatedly provide shoppers with a free sample of a product in order to test the response, Stave said. They’re also willing to offer a larger sample — such as a six-pack of soda versus one can — for higher-priced orders.

Stave added that Swish’s early campaigns are also seeing success with new-to-brand customers making over 30 repeat purchases within six months of receiving a sample.

Swish’s Sponsored Product Sampling program, which Stater Bros. implemented, has so far partnered with brands like KLIMON and Kraft Heinz, according to Stave.

Using store sampling as a touchpoint for measurement, targeting and attribution can lead to more brand lift and upper funnel contribution in grocers’ retail media arms, Stave said.

Shoppers do not need to sign up to receive samples or be part of a grocer’s loyalty program to receive a sample through Swish, but combining data from loyalty programs with Swish’s shopper data can improve the system, Stave said.

“Loyalty programs are nice to have, but not a must-have,” Stave said, adding that this is true for many attribution pieces in retail media operations.