Instacart’s announcement on Friday that it is preparing to go public made clear that the company has built a strong financial foundation in its legacy business as an e-commerce provider to retailers and is progressing quickly as it evolves into a technology company bent on helping grocers embrace digital technology online and in their brick-and-mortar operations.

Even as grocery e-commerce has recently shown sustained signs of slowing down after the pandemic sparked an unprecedented explosion in demand by online shoppers, Instacart said it believes it has plenty of room to grow its position as a digital service provider.

In the prospectus Instacart filed with the U.S. Securities and Exchange Commission, the company cited data from Incisiv that it said shows the online grocery market will post a compound annual growth rate of 10% to 18% between 2022 and 2025, compared with 0% to 4% for offline sales. Still, the company observed that given that the vast majority of grocery sales will not be digital anytime soon, “the role of the store will continue to be significant, and it will be critical to serve retailers with technology that enables omni-channel commerce.”

In addition to heralding a new era for Instacart by compelling it to reveal financial and other details about its operations it has long held close, the planned IPO also marks the end of co-founder Apoorva Mehta’s connection with the company, which he led as CEO for nine years after getting it off the ground in 2012.

Confirming plans the company disclosed in 2022, Instacart said in the prospectus that Mehta, a former Amazon supply chain engineer who has served as executive chairperson of the board since 2021, will sever his ties to the company when the registration statement becomes effective. Current CEO Fidji Simo will become chairperson when Mehta departs.

Here are six key takeaways from Instacart’s IPO registration statement.

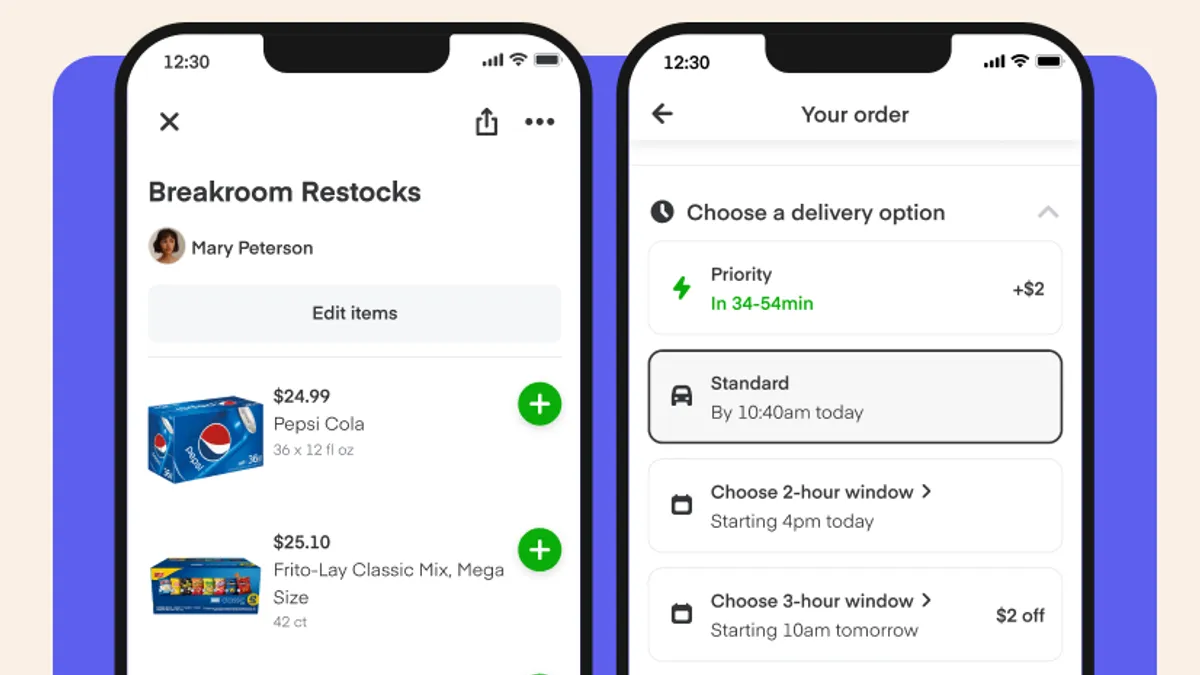

1. Instacart is positioning itself as more than a grocery delivery provider

Instacart made clear in its prospectus that the company remains strongly tied to its roots as an e-commerce service provider — and also sought to convince potential investors that it is an essential partner for grocers no matter how they approach food retailing.

The company pointed to statistics indicating that retailers it works are increasingly benefiting from their relationships with the company. According to the filing, the sales volume Instacart drives for its top 20 retail partners grew from 0.6% of their sales in 2018 to 5% of their sales last year.

At the same time, Instacart noted that while it serves more than 1,400 banners, it is heavily dependent on just a handful of retailers for more than 40% of its business. The top three retailers the company works with accounted for about 43% of Instacart’s gross transaction value in 2021, 2022 and the first half of 2023, according to the prospectus.

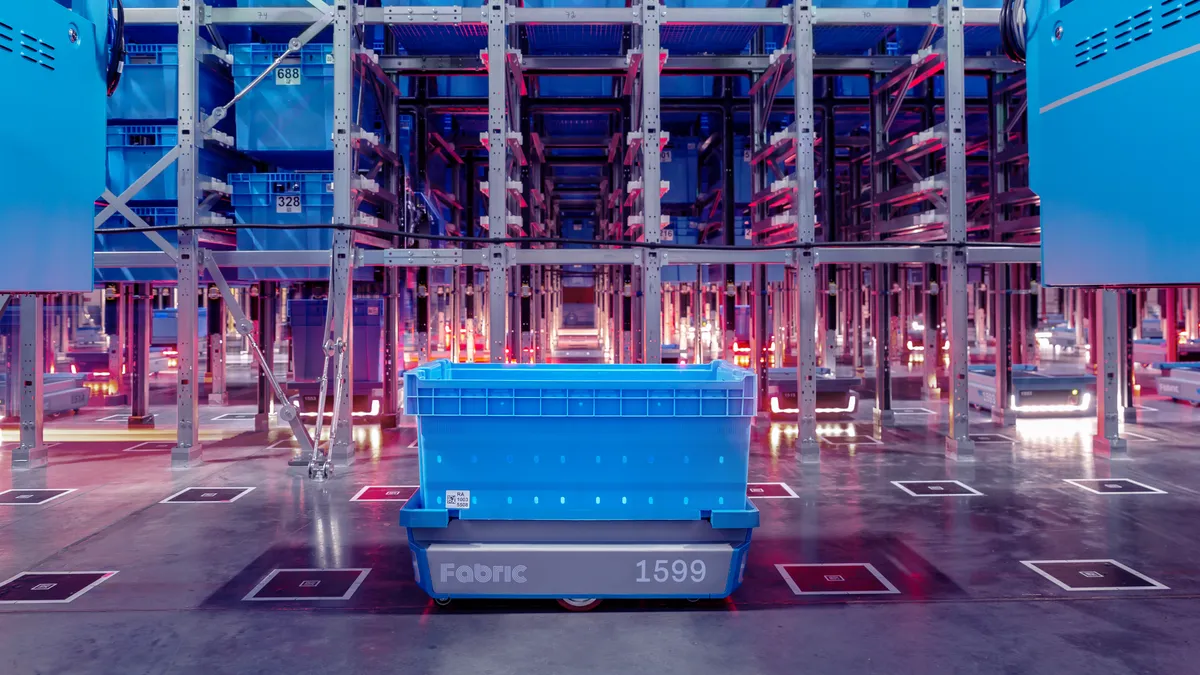

Instacart drew attention to its efforts in recent years to adapt promising technologies for retailers and move quickly to help them benefit from those new capabilities.

“We believe this incentivizes grocers to partner with Instacart, as they know that our technology will enable them to transform their businesses and enhance omni-channel customer experiences,” the company said. “Our business model has been built on shared success with grocers, and because we do not own inventory, we do not compete with our retail partners. We believe this combination puts us in a unique position to foster greater trust between grocers and Instacart, making us the preferred technology partner.”

2. The company is profitable

The company said in its filing it had a net income of $242 million during the first half of 2023, compared with a $74 million loss during the same period in 2022. Instacart said it “only recently began generating profit,” noting that its ability to generate profit rests heavily upon the growth in its diversified revenue streams, its ability to drive operational efficiencies and its cost management decisions.

Instacart recorded net losses of $70 million in 2020 and $73 million in 2021. At the end of 2022, the company had an accumulated deficit of $977 million.

Instacart said that the growth of its ads solutions plays a vital role in its ability to sustain and increase profitability.

Instacart’s revenue and profitability are on the rise

| Year | Revenue | Net income |

|---|---|---|

| 2020 | $1.5B | ($70M) |

| 2021 | $1.8B | ($73M) |

| 2022 | $2.6B | $428M* |

*Includes a $358 million tax benefit from the release of the company’s valuation allowance on deferred tax assets in the United States

3. Advertising is a key financial driver

“Advertising and other revenue” accounted for 28% of the company’s total revenue for the first half of this year, rising 24% year over year, to $406 million.

Over 5,500 brands use Instacart’s advertising tools and insights, per the filing. The company has bolstered its ads business in recent years. Its hiring of Simo as CEO in the summer of 2021 saw it bring on a high-ranking Facebook executive with experience in mobile monetization strategy, product management and advertising.

“Our grocery expertise has enabled us to build differentiated advertising solutions and tools that allow CPG brands to reach and engage with high-intent customers at the point of purchase and within minutes of delivery and consumption,” per the filing.

The company said it’s seen its advertising revenue take a hit in 2022 and the first half of this year due to reduced demand for advertising from brands who are cautious about spending amid factors like macroeconomic uncertainty, global supply chain disruptions and labor shortages.

4. It’s watchful of potential Kroger-Albertsons merger impacts

As one of its listed potential risks, Instacart notes that mergers and acquisitions by competitors or retailers could weaken its competitive position and adversely affect its business.

“Consolidation amongst major retail partners, such as the pending merger between Albertsons and Kroger, could impact contractual negotiations with such retail partners, result in lower utilization of our products, or lead ultimately to termination of existing retailer engagements,” the filing says.

The grocery industry is facing an uncertain M&A landscape that could see sizable consolidation if the massive Kroger-Albertsons and Aldi-Winn Dixie deals win regulatory approval.

5. It has high average order values

Instacart said in the filing that orders grew from 223.4 million in 2021 to 262.6 million in 2022 — an 18% increase — and that it handled 263 million orders during the 12 months that ended on June 30.

Orders have remained consistent (roughly 132 million) year over year from the six months ending June 2022 to the same period this year. In the first quarter of 2023, orders decreased 2% compared to the same quarter in the prior year, per the filing.

“Since grocery is one of the largest recurring monthly household expenses, we have high average order values,” the filing said, noting Instacart’s average order value was $110 in 2022. That year, the company’s average gross profit per order was approximately $7, or 6.4% of GTV.

“We typically see lower levels of order volume growth in the second quarter and a portion of the third quarter resulting from lower usage of our offerings during the spring and summer months, followed by higher levels of order volume growth in the second half of the year during the back-to-school period and holiday season,” per the filing.

6. Members are a top business driver

Instacart’s membership program, Instacart+, had over 5.1 million members, excluding free trial members, as of June 30. That’s up from 4.6 million members at the same time last year.

The membership, which was refreshed and rebranded in June 2022, provides unlimited free delivery on orders over a certain size, a reduced service fee and credit back on eligible pickup orders, along with other benefits.

“Instacart+ members order more frequently and have higher average order values, despite lower customer fees, and typically develop a more habitual and sticky behavior on Instacart over time,” the company said in the filing.

On average, Instacart+ members have shopped at more than twice as many retail banners than non-members. Members spend an aggregate of $461 over four orders per month, compared to an aggregate of $223 spent over two orders by a non-member, the company said.

Instacart said it will continue to invest in Instacart+ and work to increase adoption of the membership to drive increased customer engagement.

Correction: A previous version of this story misstated when Apoorva Mehta became executive chairperson of Instacart's board. He served in that role starting in 2021.