Editor’s note: This article draws on insights from a Grocery Dive virtual event panel. You can register here to watch a replay of the full event, “The Future of Omnichannel Grocery.”

With in-store shopping back in full swing following the COVID-19 pandemic, grocers are increasingly looking for ways to improve the shopping experience and build deeper connections with consumers.

While grocers have in the past treated their online and physical store operations as separate entities, retailers are now striving to combine them. This is allowing grocers to push out more targeted, personalized ads, better understand their customer base and improve shopper engagement, industry analysts and grocery company officials said Wednesday during Grocery’s Dive’s first-ever virtual event, “The Future of Omnichannel Grocery.”

“If we’re thinking about what it means to be omnichannel in this market, it’s really saying that today we have an answer for your shopping needs,” said Adenike Olaleye, Giant Food’s senior manager of e-commerce merchandising. “And by having an answer for your shopping needs, it means that whether you are in pickup, in delivery, in-store … you have the greatest experience possible.”

Bringing omnichannel into the aisles

Electronic shelf labels (ESL), apps and smart carts are among the most popular capabilities grocers have adopted in order to meld omnichannel and in-store shopping.

ESLs are growing more mainstream in supermarkets, offering shoppers valuable information about products as well as making inventory and pricing easier for workers.

The technology enables dynamic pricing as retailers can more easily tailor the cost of goods as well as promotions, making offerings “hyper-localized and hyper-personal,” Suzy Monford, CEO of Food Sport International and a former Kroger and PCC Community Markets executive, said during the event. She noted this technology is also affordable for grocers.

Meanwhile, in-store apps and smart carts bring the omnichannel experience right into consumers’ hands while relaying valuable insight back to the grocer.

“We’re seeing [in-store apps] driving more merchandise sales because a user who’s engaged with the app spends 30% more over the course of a year if they use the app, and it drives remarkable monetization and personalization benefits,” Jordan Berke, founder and CEO of Tomorrow Retail Consulting and a former Walmart e-commerce executive, said during one of the event’s panels.

Berke noted that there are four areas of innovation grocers should focus on in order to draw customers into the apps — removing friction points, value, community, and gamification.

Smart carts offer a lot of these same features without shoppers having to worry about Wi-Fi or their phone battery, Good Food Holdings CEO Neil Stern said during the session. He also noted that one element of the carts consumers gravitate towards is the ability to see how much they’re spending in real-time, adding that this control also encourages shoppers to spend more.

Making the most of third-party platforms

Creating a seamless shopping experience means ensuring customers have consistency across all omnichannel platforms, whether that’s on the grocer’s own digital marketplace or through third-party partners like DoorDash and Instacart.

“What we’re trying to do is emulate the same experience that we have on our first-party e-cart experience — that Raley’s experience — on those [third-party] marketplaces as well,” Zachary Wilson, director of digital commerce for The Raley’s Companies’ said during one of the panel sessions. “Because we know that the customers are going to be there shopping on those channels, and we want to convey the same differentiated offering that we do across our own platform.”

Though Raley’s has seen first-party delivery demand decrease, the regional grocer is seeing more transactions and orders happening overall, Wilson said. Wilson emphasized the importance of making sure that all digital platforms fully engage the customer as well as mirror what the grocer is trying to do in-store — in terms of both product offerings and pricing.

Giant Food partnered with DoorDash during its first quarter, and while the retailer has seen a shift away from delivery since the pandemic, the tie-up with the e-commerce company has helped it grow that fulfillment channel, Olalaye said. The goal is to ensure there is a fulfillment model for all customers, whether it be pickup and delivery powered by Giant or services offered by Instacart and DoorDash, she said.

Pushing private label

During the event, grocery executives emphasized the power digital platforms can have on spotlighting private label products, especially when grocers lean into the storytelling aspect of a brand.

“You get to tell the story of what a private label item is better on a digital platform than you can while customers are standing staring at the canned mixed vegetables,” said Wilson. He continued, “You have a lot more digital capabilities through those digital channels that tie that customer back to the store.”

Wilson added that tying these capabilities to a grocer’s loyalty program furthers this effort, as it allows grocers to gain insight into the private label categories that are resonating with shoppers, essentially helping “inform intent of purchase.”

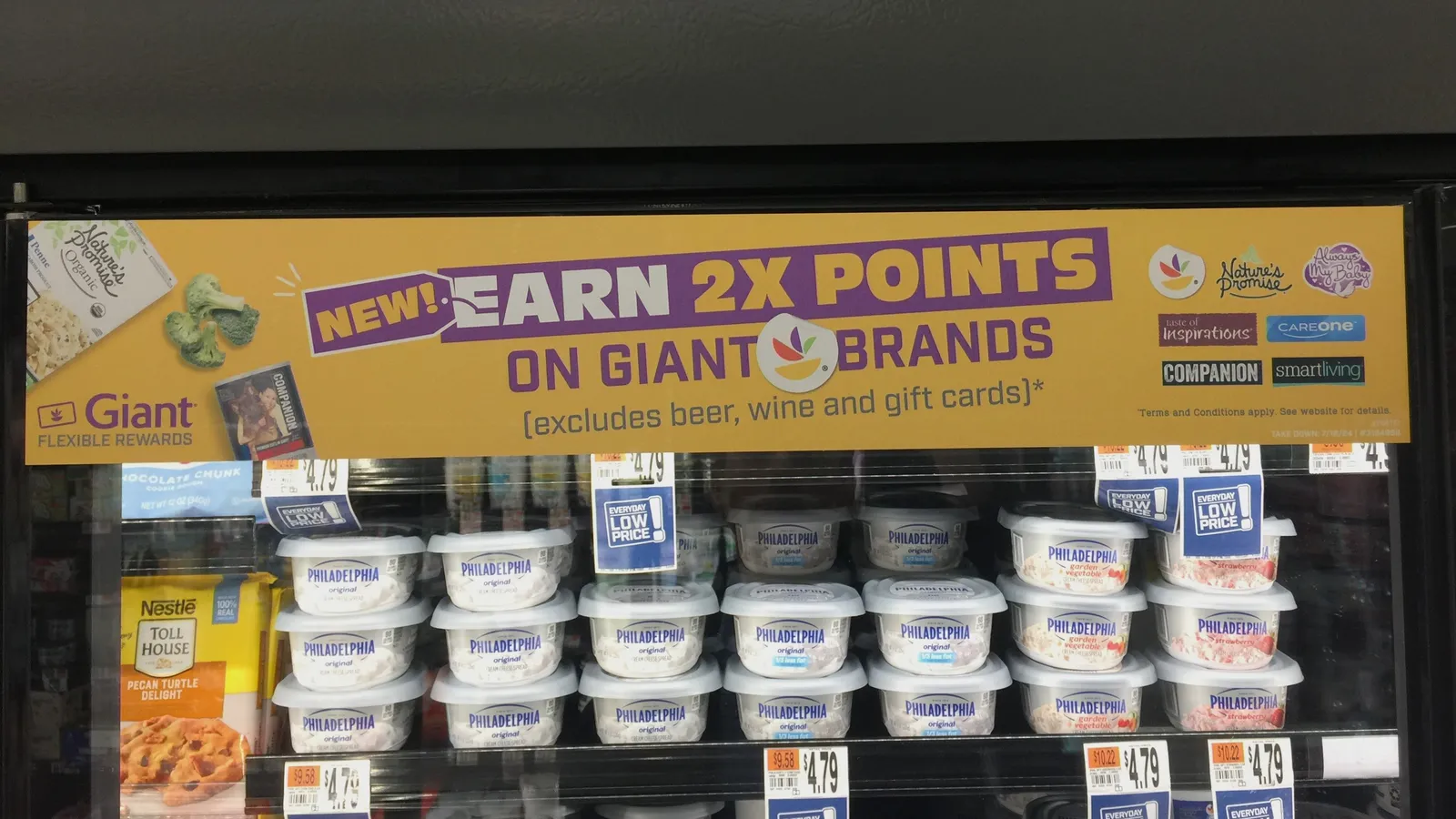

Giant recently launched a new omnichannel initiative that leverages the grocer’s loyalty and rewards program to encourage shoppers to buy more private label goods.

The regional grocer’s Compare and Save program is meant to emphasize the quality and value of its private labels, and with more of Giant’s shoppers migrating to the app, the grocer is looking to attract customers to its store brands by offering additional loyalty points, Olaleye said.

“[The program] is really to amplify us as a brand within the store as well,” she said.